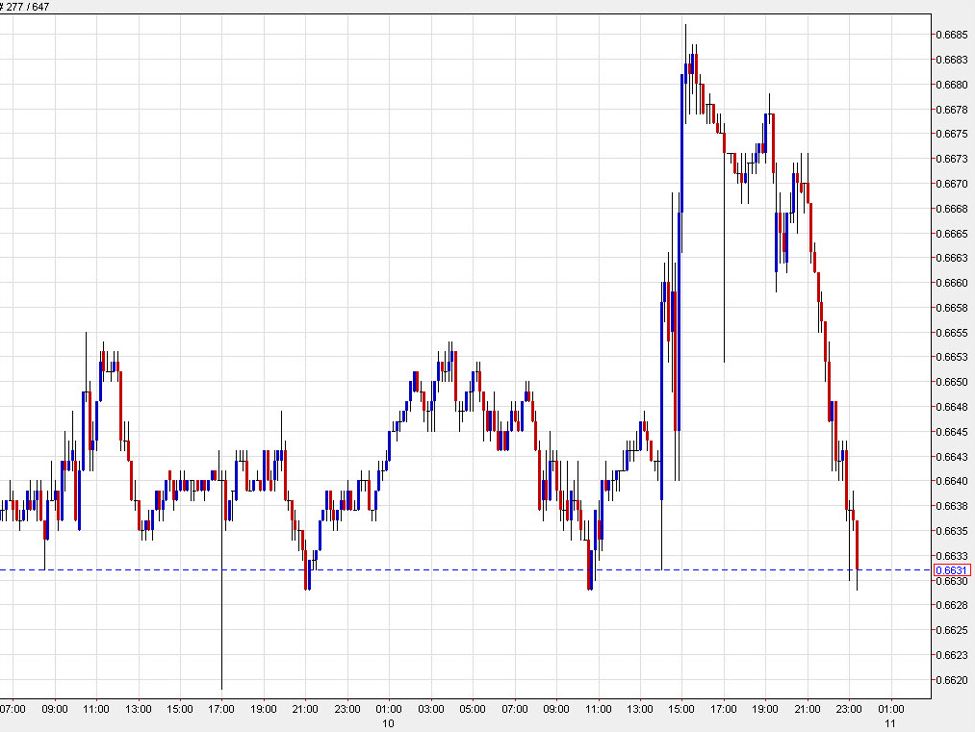

UPDATE: The Australian dollar (AUD) is experiencing a significant decline in Asian trading today as markets adjust following recent gains attributed to the Federal Reserve’s monetary policy adjustments. Just hours ago, the AUD/USD pair began unwinding its previous upward momentum, reflecting similar trends seen in stock markets.

Profit-taking became the order of the day as traders reacted to a disappointing performance from Oracle Corporation, whose shares plummeted after earnings reports. The dual pressures of profit realization and technological sector downturns have led to a shift in market sentiment.

In a positive twist for the Australian economy, the Fed raised its 2026 GDP forecast to 2.3%, up from 1.8%. This adjustment signifies potential growth in global markets, which bodes well for Australia’s commodity exports. However, sentiment is dampened by ongoing struggles in Chinese stocks, fostering uncertainty regarding Australia’s economic trajectory.

Market analysts suggest that while the Fed’s optimistic forecast offers some reassurance, it may not be enough to reverse the current bearish trend for the AUD. “We need a more substantial catalyst than the Fed to invigorate the markets,” noted Adam Button from investinglive.com. As traders brace for potential volatility, the consensus is that a significant change could be on the distant horizon, potentially not materializing until 2026.

Investors are advised to monitor the evolving situation closely as the Australian dollar’s movements could have far-reaching implications for the economy, especially in light of the global growth landscape. The coming weeks will be critical in determining whether the AUD can regain its footing amid these shifting market dynamics.

This developing story highlights the urgency for traders and investors alike as they navigate the complexities of the current economic environment. Stay tuned for further updates as this situation unfolds.