BREAKING: Tokyo’s inflation rate has eased more than expected in December 2023, now at 2.3% year-on-year, down from 2.8% in November. This decline, however, still keeps inflation above the Bank of Japan’s (BOJ) 2% target, ensuring that the central bank’s gradual rate hike strategy remains on course.

The latest Consumer Price Index (CPI) data released today signals an easing of price pressures, largely influenced by falling utility and energy costs as well as a moderation in food price increases. The BOJ had recently raised its policy rate to 0.75%, the highest level in nearly three decades, and indicated that further tightening could occur if inflation aligns with their forecasts.

In detail, the core CPI, which excludes fresh food, fell short of market expectations of 2.5%. A closely monitored “core-core” measure, which strips out both fresh food and energy, also softened to 2.6%, down from 2.8% previously. The headline CPI decreased to 2.0% from 2.7%, marking the first significant easing in Tokyo’s inflation since August.

This data arrives as the BOJ continues to navigate its policy normalization amidst persistent inflation levels. Governor Kazuo Ueda emphasized that additional rate hikes are anticipated if wages and prices evolve as projected, though he refrained from providing specific guidance on timing or ultimate rate levels.

Market analysts interpret the December CPI results as consistent with the BOJ’s baseline scenario: inflation is gradually cooling as energy price impacts diminish, yet remains robust enough to warrant further rate increases in the future. The prevailing expectation is for a gradual hiking cycle, with projections suggesting rates will rise approximately every six months, potentially reaching a terminal level near 1.25% if wage growth maintains its strength.

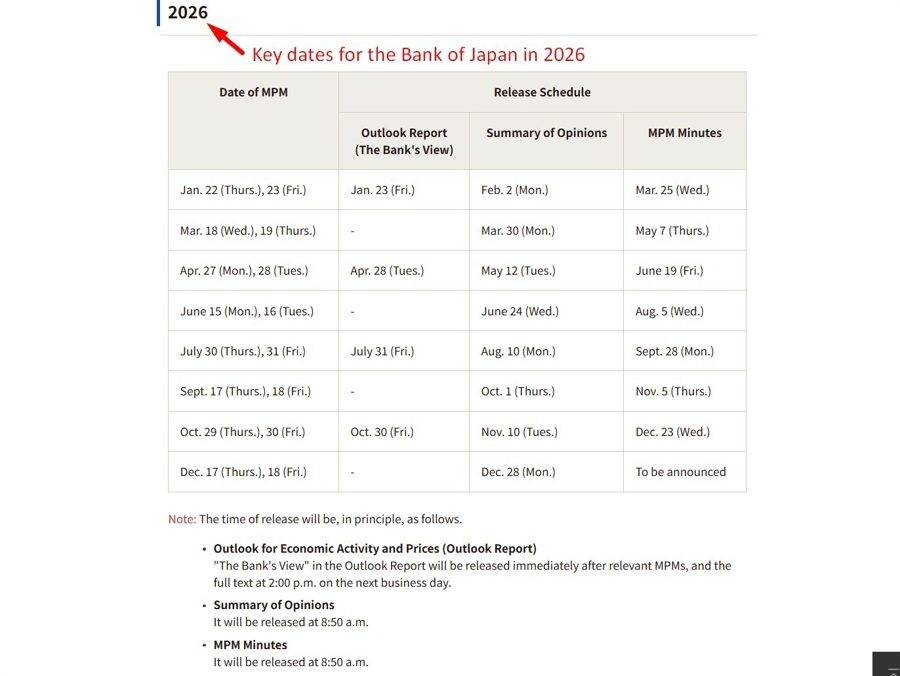

As a result of the softer-than-expected inflation print, immediate pressure for a follow-up rate hike has slightly diminished. However, the overall tightening trajectory remains intact, indicating a cautious approach from the BOJ moving forward. Analysts suggest that a pause at the next monetary policy meeting scheduled for January 22-23, 2026 is likely.

Investors are closely monitoring the implications of these developments on the Japanese yen, Japanese Government Bonds (JGBs), and the Nikkei stock index, as market reactions to inflation trends and central bank policies continue to unfold.

Stay tuned for further updates as this situation develops.