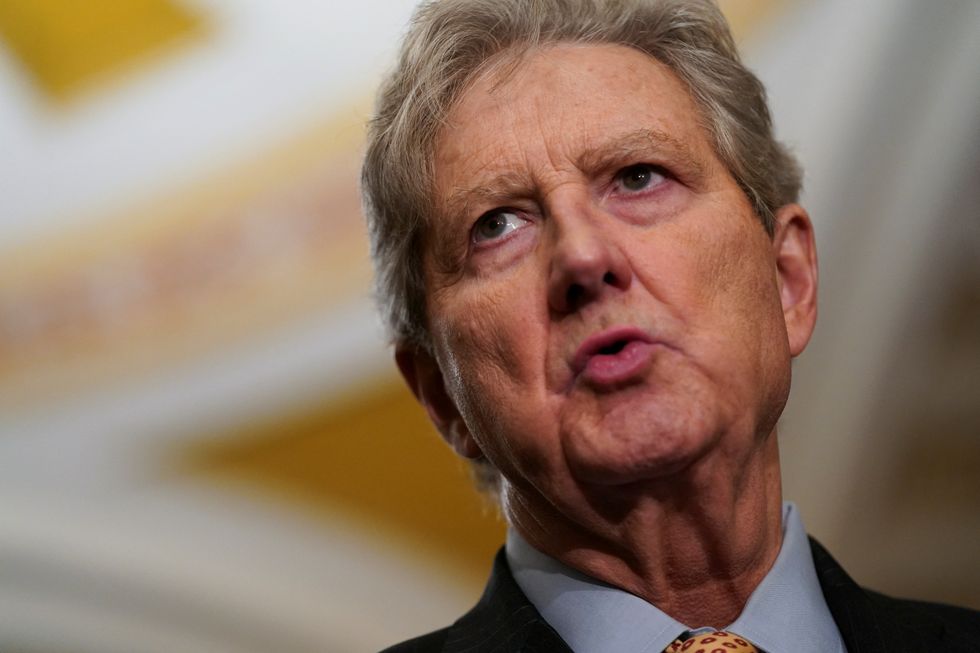

UPDATE: Tensions erupted during a Senate Banking Committee hearing today as Sen. John Kennedy (R-LA) delivered a scathing rebuke to Travis Hill, President Donald Trump‘s nominee to permanently lead the Federal Deposit Insurance Corporation (FDIC). Kennedy’s fiery comments come amid serious allegations of “pervasive sexual harassment and discrimination” at the agency, following a bombshell external investigation in 2024.

Kennedy expressed his frustration after Hill indicated that no changes were being implemented in response to the investigation’s findings. “I have had enough of this, and if your name came up in front of me right now, I wouldn’t vote for you,” Kennedy declared, emphasizing his disapproval of Hill’s leadership amidst the scandal.

The senator’s strong stance could significantly impact Hill’s confirmation process, especially as all Democrats on the committee are expected to oppose him. Hill, who previously served as a senior aide and vice chair at the FDIC, has not been personally implicated in any misconduct. However, Kennedy is demanding accountability. He ordered Hill to provide a detailed report within 30 days on how the FDIC is addressing the harassment accusations and other workplace misconduct claims.

“Otherwise, you can forget about my vote,” Kennedy warned. “Until I’m convinced that they’re not going to sweep this under the rug — and that there’s going to be justice for these young women that they touched and harassed and tried to have sex with — then I’m not going to go for him,” he added, highlighting the urgency for reform at the agency.

In a counter to Hill’s assurances that “reforming the culture continues to be a top priority,” Sen. Elizabeth Warren (D-MA) criticized Hill’s claims, stating there is “no record” of any meaningful actions taken to rectify the issues.

As the situation develops, all eyes will be on the FDIC and its leadership. The outcome of this confirmation hearing could set a precedent for how allegations of misconduct are addressed within federal agencies, making it a critical moment for accountability and workplace culture reform.

Stay tuned for further updates on this urgent situation as the Senate Banking Committee continues its deliberations.