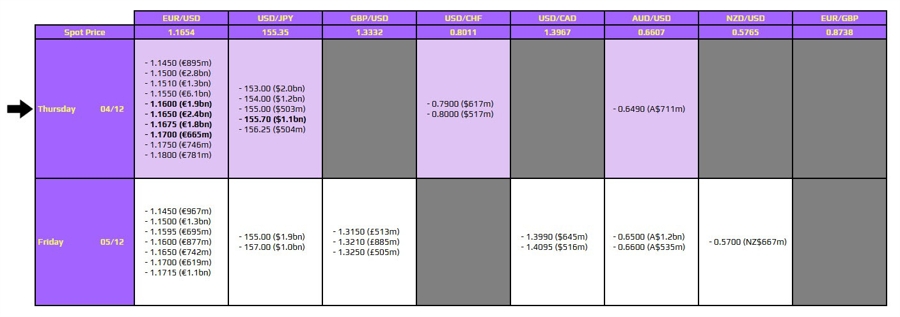

UPDATE: Significant FX option expiries are set for today, December 4, 2023, at 10 AM ET in New York, impacting key currency pairs. The focus is on EUR/USD, with major expiries layered between 1.1600 and 1.1700, particularly concentrated around the 1.1650 level. This critical range is likely to restrain price movements throughout the trading session.

As the dollar shows signs of weakness, this could bolster EUR/USD, keeping it supported this week. However, the large expiries in play could limit volatility until they roll off later today, making this a pivotal moment for traders.

In addition, USD/JPY faces notable expiries at the 155.70 mark, closely aligned with the 100-hour moving average at 155.67. This technical alignment may restrict any upward movements in the short term. Market sentiment reflected a bearish trend for USD/JPY since yesterday, driven by a softer dollar and heightened expectations for a potential rate hike from the Bank of Japan (BOJ) this month.

Traders are advised to stay alert as these developments unfold, as they could significantly influence market dynamics. For more insights, visit investingLive (formerly ForexLive), where expert analyses are readily available.

Today’s market activity is critical; with major expiries looming, traders must be prepared for potentially sharp price reactions. Stay tuned for updates as the situation evolves!