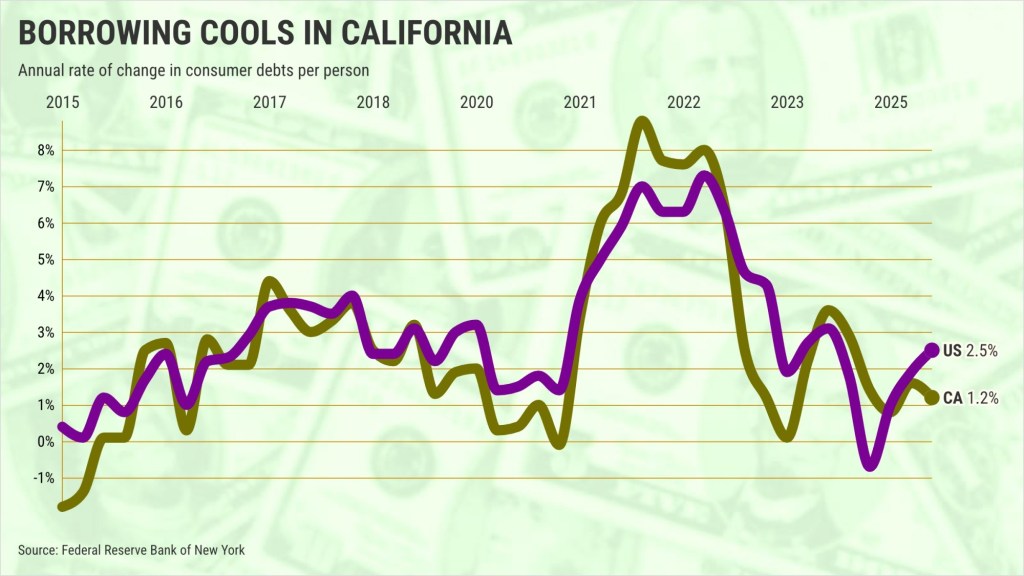

URGENT UPDATE: A troubling trend is emerging in California as residents slow their borrowing while late bill payments surge, signaling rising financial stress. New data from the Federal Reserve Bank of New York reveals that in the third quarter of September 2025, Californians averaged $87,570 in consumer debt per person, marking a mere 1.2% increase from the previous year, down from 2.9% growth.

This cooling in borrowing comes amidst growing economic anxiety, as consumer confidence in California has plummeted by 18% over the past year, according to the Conference Board. The rising stress is further underscored by the fact that 2.01% of consumer bills in California are now overdue by 90 days or more, the highest rate since early 2020.

While this delinquency rate remains below the long-term average of 3.56%, it highlights a significant shift in consumer behavior amidst economic uncertainty. By comparison, the national average for late payments stands at 2.98%, indicating that Californians are managing their debts more effectively than many others across the country.

In stark contrast, Texas is seeing a sharp increase in consumer debt, with an annual rise of 4.1% to $60,100 per person, and Florida following closely with a 3.5% increase to $62,460. This divergence highlights a growing economic disparity as Californians take a more cautious approach to borrowing.

The economic strain is exacerbated by the end of federal student loan repayment pauses, contributing to a nationwide surge in unpaid student debts. Currently, 14.3% of student loans are unpaid, a dramatic rise from 0.8% last year, marking the highest level recorded since data collection began in 2000. California, however, reports a lower average of student debt per capita at $4,710, which constitutes just 5% of overall borrowings in the state.

As these trends continue to unfold, experts urge Californians to remain vigilant and proactive in managing their finances. Those observing this situation should keep an eye on upcoming economic reports and consumer confidence indices, which could signal further shifts in borrowing patterns and financial stability.

For immediate updates, stay tuned as this developing story progresses. The implications of these trends are significant, not just for Californians but for the national economy overall.