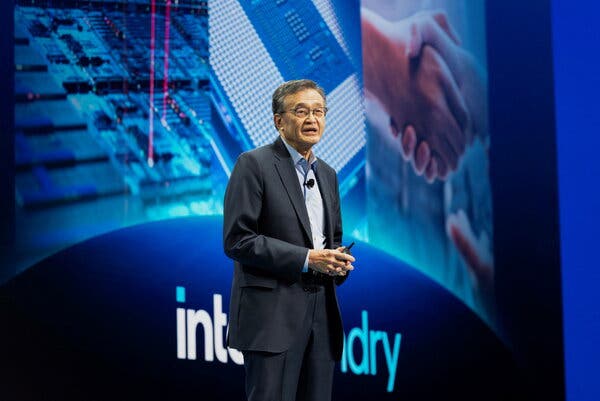

Intel, the renowned chip manufacturer, recently found itself at the center of a complex situation involving its Chief Executive Officer, Lip-Bu Tan. This summer, the company made an offer to acquire Rivos, a start-up specializing in artificial intelligence chips. However, Rivos ultimately entered into an agreement with Meta in October 2023. While the financial terms of the acquisition remain undisclosed, Rivos was valued at approximately $2 billion prior to the sale.

This scenario highlights a unique intersection of responsibilities for Tan, who was appointed CEO of Intel in March 2023. In addition to leading one of the world’s largest semiconductor firms, he has a long-standing career as a technology investor. Since 1987, he has directed Walden International, a venture capital firm that has invested in over 500 companies. Tan also co-founded Celesta Capital in 2013 and Walden Catalyst in 2021. Notably, Rivos was among the start-ups backed by Walden Catalyst, where Tan served as the founding chairman. Following the acquisition by Meta, he expressed his pride on LinkedIn, stating his satisfaction with the deal.

Despite his lack of direct involvement in Intel’s negotiations with Rivos, sources indicate that Tan stands to gain financially from the transaction due to his investment connections. His dual roles have raised eyebrows within the technology sector and at Intel itself. Reports suggest that his positions have led to perceived conflicts of interest, prompting concern among employees.

Concerns Over Conflicts of Interest

The overlapping responsibilities of Tan have led to scrutiny from various stakeholders, including employees who have left Intel amid these controversies. Interviews with over a dozen individuals familiar with the company reveal that some former employees cited Tan’s dual roles as a factor in their departure. They expressed apprehension regarding potential conflicts of interest that could arise from his simultaneous leadership of Intel and involvement with investment firms.

Further complicating the situation, Intel has also engaged in discussions to acquire SambaNova Systems, where Tan serves as executive chairman and investor. This has raised additional questions about the appropriateness of his influence over Intel’s strategic decisions, particularly when discussing SambaNova’s offerings with major clients, such as Dell.

As the landscape of the semiconductor industry continues to evolve, the balance between Tan’s roles as both a CEO and a private investor remains a point of contention. The ramifications of his leadership decisions will likely impact Intel’s reputation and operational integrity moving forward. The ongoing debate around conflicts of interest in high-profile executive roles underscores the need for transparency and ethical considerations in corporate governance.

In conclusion, as Lip-Bu Tan navigates the complexities of his dual roles, stakeholders will be watching closely to see how these dynamics unfold within Intel and the broader technology sector.