Nomura Asset Management Co. Ltd. has reduced its stake in Microsoft Corporation (NASDAQ: MSFT) by 2.4% during the second quarter of 2023, as indicated in its recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor now holds 3,896,607 shares of Microsoft, having sold 97,306 shares during this period. This adjustment reflects Microsoft’s significant role in Nomura’s portfolio, where it constitutes 5.3% of total investments, making it the second largest holding for the firm, valued at approximately $1.94 billion.

Several other institutional investors have also modified their positions in Microsoft recently. Bulwark Capital Corp acquired a new position valued at $32,000, while Westend Capital Management LLC increased its holdings by an impressive 386.7%, now owning 73 shares worth $36,000. LSV Asset Management entered the market with a new stake valued at about $44,000, and PayPay Securities Corp raised its investment by 29.9%, bringing its total to 126 shares valued at $63,000. Legend Financial Advisors Inc. also made a new investment worth approximately $69,000. Currently, hedge funds and institutional investors own about 71.13% of Microsoft’s stock.

Analyst Ratings and Stock Performance

Microsoft has been the subject of various analyst reports recently. Piper Sandler maintained an “overweight” rating and set a price target of $650.00 for the shares. Baird R W upgraded Microsoft to a “strong-buy” rating, while DZ Bank reaffirmed a “buy” status. TD Cowen raised its price objective from $640.00 to $655.00, and Truist Financial increased its target from $650.00 to $675.00. According to MarketBeat.com, Microsoft currently holds a consensus rating of “Moderate Buy” with a price target of $632.34.

On the trading front, Microsoft shares opened at $483.16 and have experienced a 0.5% increase. The company has a 52-week low of $344.79 and a high of $555.45. Microsoft’s market capitalization stands at $3.59 trillion, with a price-to-earnings (P/E) ratio of 34.36 and a P/E growth (P/E/G) ratio of 1.81. The stock has a beta of 1.07, and its financial ratios include a quick ratio of 1.39 and a current ratio of 1.40.

Recent Earnings and Dividend Announcement

Microsoft announced its quarterly earnings on October 29, 2023, reporting earnings per share (EPS) of $4.13, surpassing analysts’ expectations of $3.65 by $0.48. The company’s revenue for the quarter reached $77.67 billion, exceeding the consensus estimate of $75.49 billion. Microsoft demonstrated a net margin of 35.71% and a return on equity of 32.45%, marking an 18.4% increase in revenue compared to the same period last year.

Additionally, a quarterly dividend of $0.91 per share was announced, with payment scheduled for March 12, 2024. Shareholders of record as of February 19, 2024, will be eligible for this dividend, representing an annualized payout of $3.64 and a yield of 0.8%. Currently, Microsoft’s payout ratio is 25.89%.

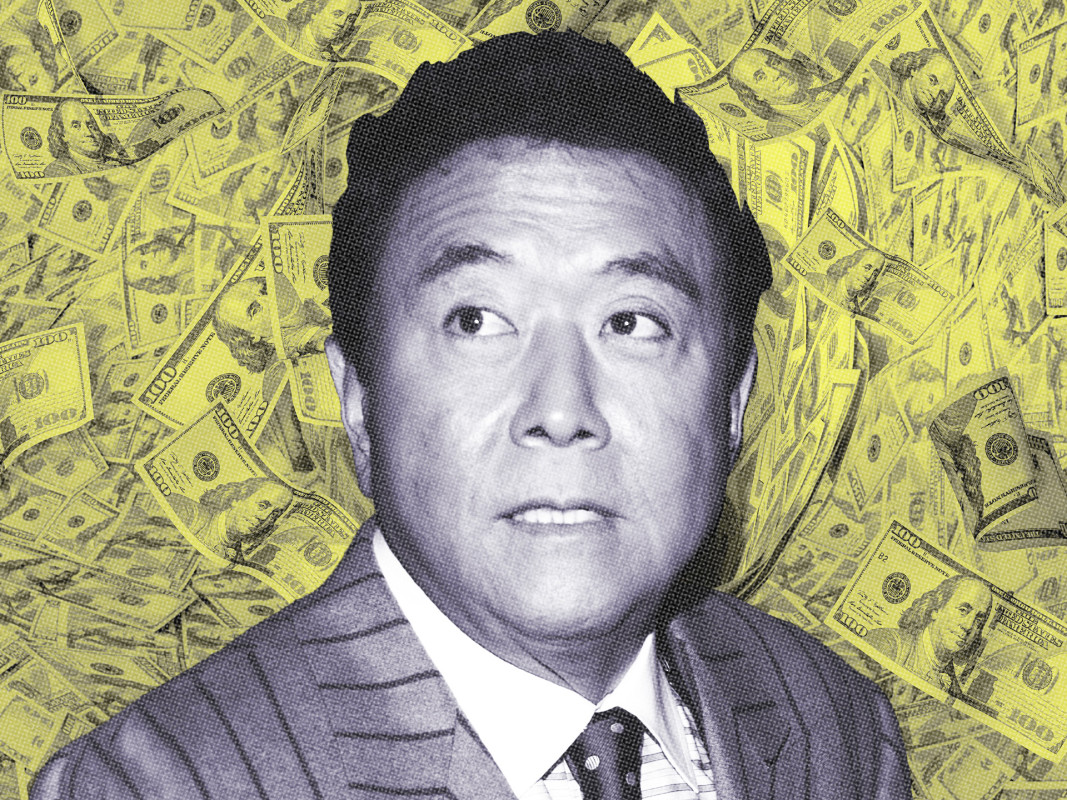

In insider trading news, Bradford L. Smith, an executive at Microsoft, sold 38,500 shares at an average price of $518.64 on November 3rd, totaling approximately $19.97 million. Following this transaction, he retains 461,597 shares valued at about $239.40 million. Another executive, Takeshi Numoto, sold 2,850 shares at an average price of $478.72, resulting in a total of $1.36 million. Insiders have sold a total of 54,100 shares valued at $27.60 million within the last 90 days, while insider ownership in the company remains at 0.03%.

Microsoft Corporation continues to be a leading player in the software industry, developing and supporting a wide range of software, services, and solutions across the globe, including its well-known Office and cloud computing services.