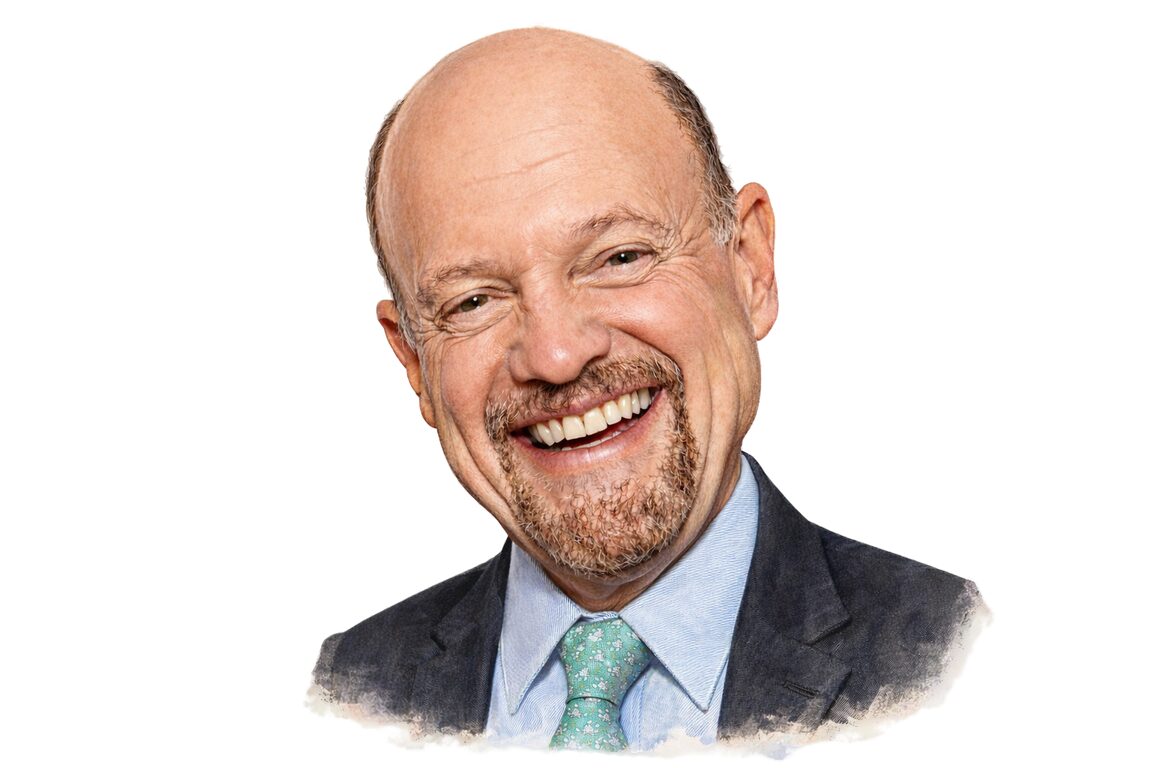

Jim Cramer, the host of the financial television program *Mad Money*, has provided insights on nine stocks in light of ongoing market fluctuations and government involvement in the economy. Speaking on January 27, 2025, Cramer emphasized the significant influence of President Donald Trump on the stock market, remarking that investors must navigate both the opportunities and challenges presented by government policies.

Cramer described the current economic environment as resembling a “command economy,” where investors must align with the president’s terms to avoid potential ramifications. He highlighted that Trump’s administration is pushing for a one-year cap on credit card interest rates at 10%, a move that could have repercussions for financial institutions heavily reliant on credit card revenue. Cramer noted that while some banks are struggling as a result, others are thriving due to diverse revenue streams.

Market Reactions and Stock Insights

Among the stocks discussed, Cramer presented a mix of companies, each with unique potential and risks. Notably, he labeled Suburban Propane Partners, L.P. (NYSE:SPH) a “core dividend stock.” However, he cautioned against investing in propane, stating, “It’s just too inconsistent,” highlighting the volatility in that sector.

In contrast, Credo Technology Group Holding Ltd (NASDAQ:CRDO) received a more positive assessment. Cramer acknowledged insider selling but maintained that Credo possesses a compelling growth story within the high-speed connectivity sector. He remarked, “Just because we haven’t figured out how all the financing is going to happen… Credo still works for me.”

Cramer also addressed Comfort Systems USA, Inc. (NYSE:FIX), a company he has long endorsed. He praised its performance, especially following a strong third-quarter revenue report driven by demand in data centers and AI-related infrastructure. His enthusiasm was reflected in his past support, as he recalled, “I liked that stock when it was like… I don’t know, like 20 bucks.”

Further analysis included Figma, Inc. (NYSE:FIG), which Cramer noted has faced a significant decline of over 20%. He expressed skepticism about the design software industry, particularly with Adobe’s competitive presence, stating, “I really don’t want to touch design software.”

Contrasting Perspectives on Investment Opportunities

Other notable stocks included Mueller Industries, Inc. (NYSE:MLI), where Cramer reiterated his belief in the company’s long-term prospects, especially in infrastructure. He mentioned, “Slow and steady wins the race,” reflecting his confidence in Mueller’s continued growth.

Meanwhile, Cramer approached Ramaco Resources, Inc. (NASDAQ:METC) with caution despite its recent stock performance. He suggested that while the metallurgical coal market may benefit from government interest, the company’s inconsistent dividend strategy and confusing corporate structure warrant a more conservative investment stance.

In discussing Chipotle Mexican Grill, Inc. (NYSE:CMG), Cramer recognized its recent struggles but suggested it might be time to buy at a lower price point. He indicated that the stock’s valuation, trading at 34 times earnings, could present a buying opportunity if it continues to decline.

Lastly, Cramer briefly touched on Moderna, Inc. (NASDAQ:MRNA), particularly its developments in cancer vaccines. While acknowledging the stock’s impressive performance, he urged caution, advocating for a wait-and-see approach given its significant price increase of 54% for the year.

Cramer’s commentary reflects a broader observation regarding the intricate relationship between government actions and stock performance, suggesting that investors must remain vigilant and adaptable in this evolving landscape.