UPDATE: A stunning new report from Virginia-based research institute AidData reveals that China’s global lending portfolio has surged to $2.1 trillion, significantly larger than previous estimates. This finding underscores China’s position as the world’s largest creditor, surpassing traditional powers in the race for global influence.

This urgent development comes as the world grapples with the implications of China’s extensive lending practices, which peaked during the Belt and Road Initiative in the 2010s. With over $1 trillion in obligations, China’s loans have raised concerns about potential financial distress in recipient countries, leading critics to label these practices as “debt-trap diplomacy.”

Officials in Beijing, however, refute these accusations, maintaining that their lending approach is rooted in mutually beneficial, market-driven principles. In a recent inquiry, Newsweek reached out to China’s Foreign Ministry for comment, but no response has been reported yet.

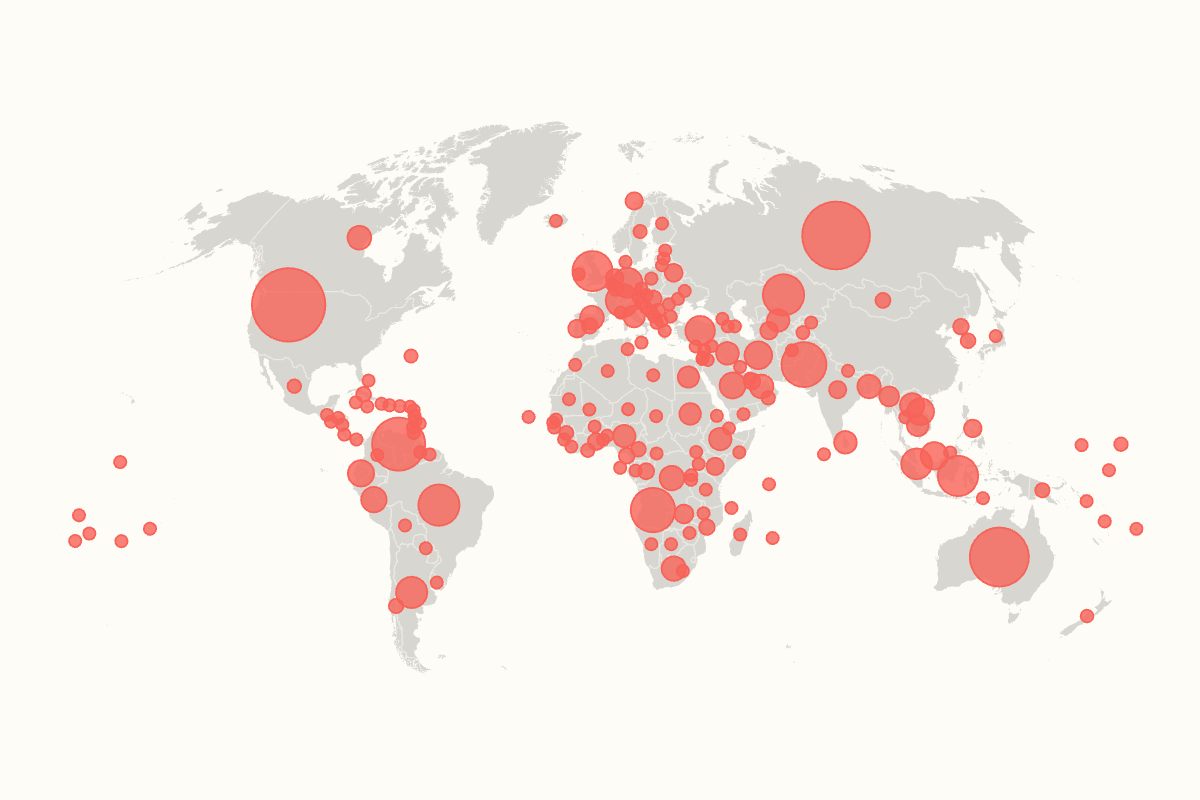

The AidData report, compiled over three years and encompassing 30,000 projects across 217 countries, reveals that 76 percent of these loans were directed towards high- and upper-middle-income nations, challenging the narrative that China’s financing predominantly supports developing countries.

Among the top ten recipients of Chinese loans, the United States leads the pack with a staggering $202 billion covering 2,500 projects nationwide. Following the U.S. is Russia with $172 billion, and Australia with $130 billion. Other notable borrowers include Venezuela and Pakistan, with $105.7 billion and $75.6 billion respectively. The United Kingdom ranks tenth with significant loans affecting their economic landscape.

The report’s authors emphasize that China is redefining the rules surrounding international aid and credit, forcing the U.S. and other major lenders like Germany and Japan to reassess their strategies in response to this shifting dynamic.

Brad Parks, executive director of AidData, stated:

“This is an extraordinary discovery given that the U.S. has spent the better part of the last decade warning other countries of the dangers of accumulating significant debt exposure to China.”

Yang Baorong, a prominent figure at the Chinese Academy of Social Sciences, contended that China’s financing primarily aims to bolster infrastructure and self-reliance rather than induce dependency, as reported by state-run Global Times.

As this situation continues to unfold, global policymakers and economies must stay alert to the implications of China’s substantial financial influence. The authors of the report highlight that China’s unique position as a “new global pace-setter” is indeed altering the landscape of international loans and aid, and the ripple effects will be felt across borders.

Stay tuned for further updates on this developing story as it shapes the future of global economic relations.