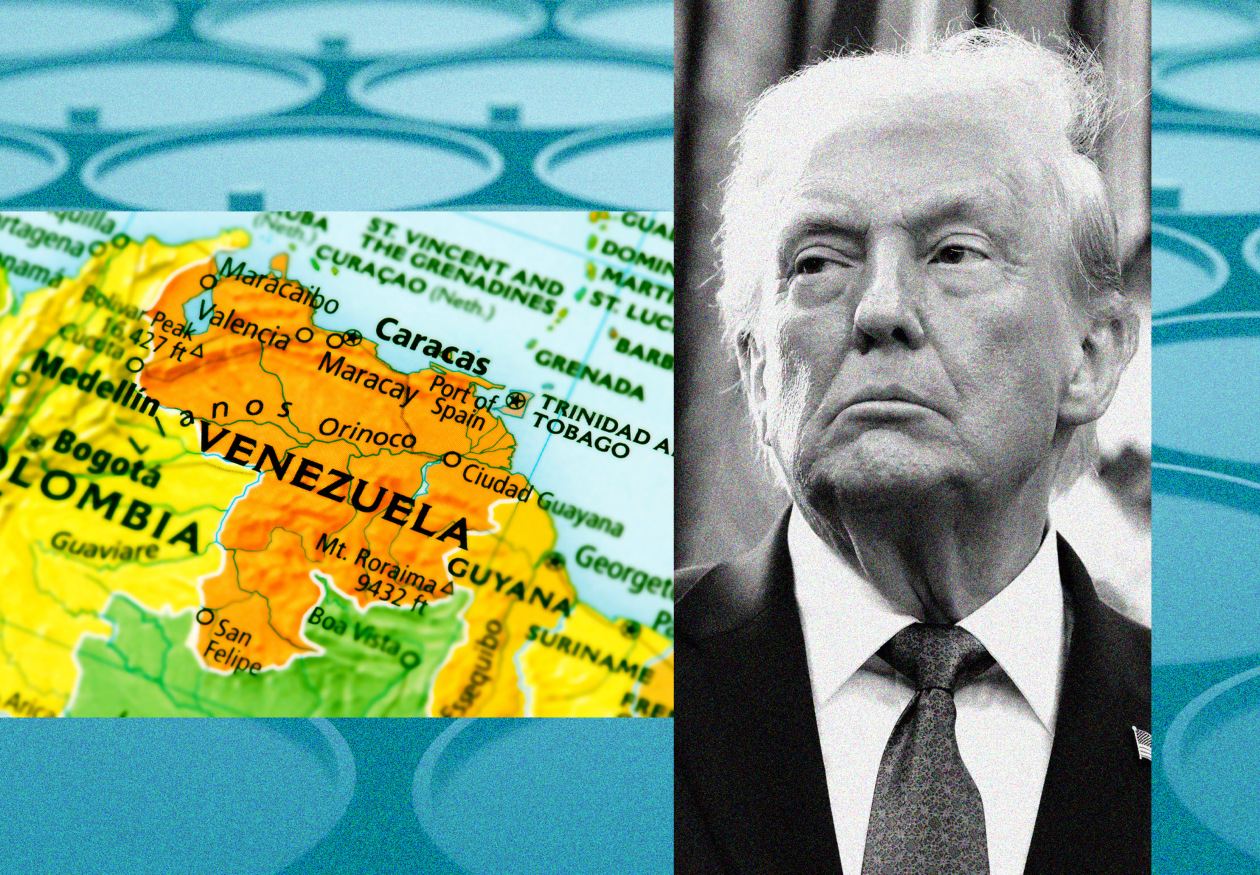

UPDATE: President Donald Trump is set to hold a critical meeting on Friday with top executives from major oil companies, including Exxon Mobil, Chevron, and ConocoPhillips, to discuss potential energy investments in Venezuela. This high-stakes gathering could unlock up to $40 billion in new U.S. energy investment, marking a significant shift in relations with the South American nation.

This meeting comes on the heels of a major development: the recent capture of Venezuelan President Nicolás Maduro. The implications of Trump’s discussions could transform the U.S. energy landscape and reshape Venezuela’s economy, which has been in turmoil for years. Executives from the oil industry will gather to explore opportunities in a country rich in resources but plagued by political instability and economic collapse.

The urgency of this meeting cannot be overstated. With the U.S. looking to expand its energy footprint in Venezuela, the outcome could affect global oil prices and investment strategies. Analysts are keenly watching how this engagement might pave the way for American companies to re-enter the Venezuelan market, which has been largely off-limits due to sanctions.

Sources close to the discussions reveal that the executives will address both the potential for investment and the challenges posed by ongoing sanctions. The stakes are high, not only for investors but also for the countless Venezuelans affected by the country’s dire economic situation. Increased investment could lead to job creation and improved living conditions for many, but it also raises concerns about the ethical implications of engaging with a regime that has faced international condemnation.

As the meeting approaches, the oil industry is buzzing with anticipation. The outcomes could set the stage for a new era of U.S.-Venezuela relations, with far-reaching effects on global energy markets. Observers expect that details of the discussions will emerge shortly after the meeting, offering insights into how the U.S. plans to navigate this complex geopolitical landscape.

What happens next? Investors and industry analysts will be watching closely for any announcements regarding specific investment plans or partnerships. The potential for a significant influx of U.S. capital into Venezuela could reshape the region’s energy dynamics and alter the landscape for international investments in Latin America.

Stay tuned for more updates as this story develops, and prepare for potential impacts on the oil market and broader economic implications. This meeting could mark a turning point not just for Venezuela but for U.S. energy policy as well.