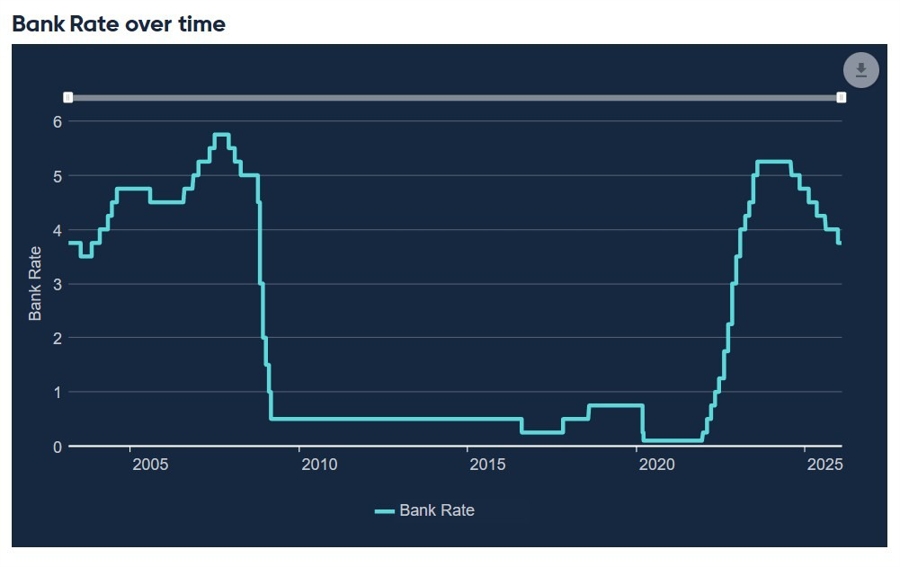

UPDATE: The Bank of England is set to keep interest rates unchanged at 3.75% during its upcoming announcement on February 5, 2024. This decision comes as inflation trends exhibit signs of cooling; however, persistent wage growth raises concerns among policymakers.

Despite recent expectations for a rate cut delivered just before Christmas, the Bank is adopting a cautious approach. Officials indicate that while headline inflation is projected to decline sharply in the coming months, underlying pressures—especially from services inflation and wage growth—remain elevated. This complexity is leading members of the Monetary Policy Committee to hesitate in declaring victory over inflation.

The market is sharply focused on the vote split during the upcoming meeting. A close or divided vote could signal that the committee is edging towards further easing, even if the rate remains unchanged. Conversely, a unified decision to hold rates steady would highlight ongoing concerns about domestic inflation pressures, particularly within the labor market.

Current market pricing reflects this uncertainty, with investors significantly reducing expectations for near-term rate cuts. The likelihood of easing has diminished amid persistent inflation concerns and shifting global dynamics, including stronger economic momentum in the UK and reassessments of U.S. policy easing.

Officials are expected to maintain a cautious stance and provide non-specific guidance, emphasizing a data-dependent approach rather than concrete signals for future cuts. Updated economic projections are not anticipated to show major changes from previous forecasts, which already indicated inflation hovering around target levels in the medium term.

Policymakers are also prepared to respond to external risks, which include geopolitical uncertainties and fluctuations in global financial conditions. While market reactions have been relatively muted, the focus will remain on the Bank’s messaging. Any nuanced shifts in language regarding wages, labor-market conditions, or financial stability could significantly influence market expectations for future monetary policy moves.

As the February 5 date approaches, investors and analysts will be closely monitoring the implications of the Bank’s decisions and statements. The outcome will not only affect monetary policy but also have far-reaching consequences for the UK economy and beyond. The urgency of this situation is palpable, as businesses and consumers alike await clarity on the path forward.

Stay tuned for real-time updates as this story develops.