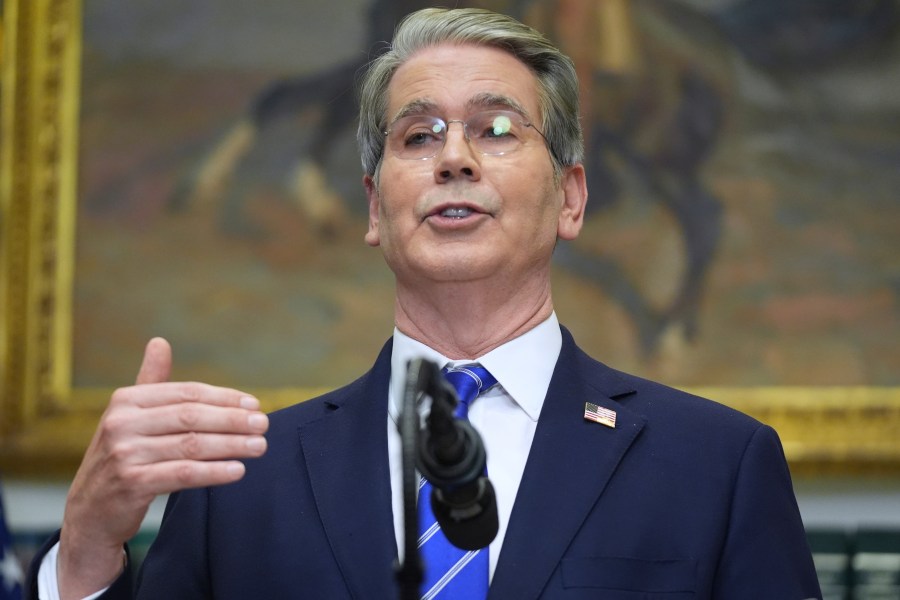

The popular K-pop artist and actor Cha Eunwoo, a member of the boy band ASTRO, is currently facing serious allegations of tax evasion involving ₩20.0 billion KRW (approximately $13.8 million USD). He has engaged Sejong, one of South Korea’s leading law firms, as he prepares for a direct confrontation with the National Tax Service (NTS). Legal experts suggest that while there may be a chance for Cha Eunwoo to win in court, the fallout from the scandal could irreparably damage his public image.

On March 28, the Roel Law Firm released a video discussing the tax evasion allegations against Cha Eunwoo. Lawyer Lee Tae Ho highlighted the NTS’s tendency to impose heavy taxes, arguing that they often interpret laws in favor of the state. He explained, “They first impose heavy additional taxes and then dispute the matter in court afterward.” Lee emphasized that large law firms have had success in contesting the NTS’s decisions, noting, “Since the possibility of excessive taxation by the tax authorities cannot be ruled out, we must watch the outcome until the very end.”

Despite the potential for a legal victory, Lee cautioned that the damage to Cha Eunwoo’s reputation may linger regardless of the court’s decision. He stated, “Most entertainers reach a settlement with the tax authorities at a certain level and close the case.” In Cha Eunwoo’s situation, Lee suggested that the NTS pressured him into refusing a settlement, resulting in the imposition of additional taxes. “Even if he wins the tax lawsuit later, the public will only remember that he evaded taxes,” he added, predicting that the issue will continue to haunt him even after his mandatory military service.

The NTS flagged Cha Eunwoo’s income structure as suspicious, leading to a notification for additional income tax exceeding ₩20.0 billion KRW. The agency is scrutinizing the service contract and profit distribution between a company established by Cha’s mother, Ms. Choi, and his agency, Fantagio. Authorities suspect that this company may be a “paper company” lacking genuine business activities.

As the controversy escalated, Cha Eunwoo issued a public apology on March 26, acknowledging the concerns and disappointment caused by the allegations. He stated, “As a citizen of Korea, I am deeply reflecting on whether my attitude toward my tax obligations was lacking.”

The unfolding situation raises critical questions about the implications for Cha Eunwoo’s career and reputation. The music industry and fans alike will be closely monitoring the developments in this high-profile case, which not only impacts Cha but also reflects broader issues surrounding tax compliance in the entertainment sector.