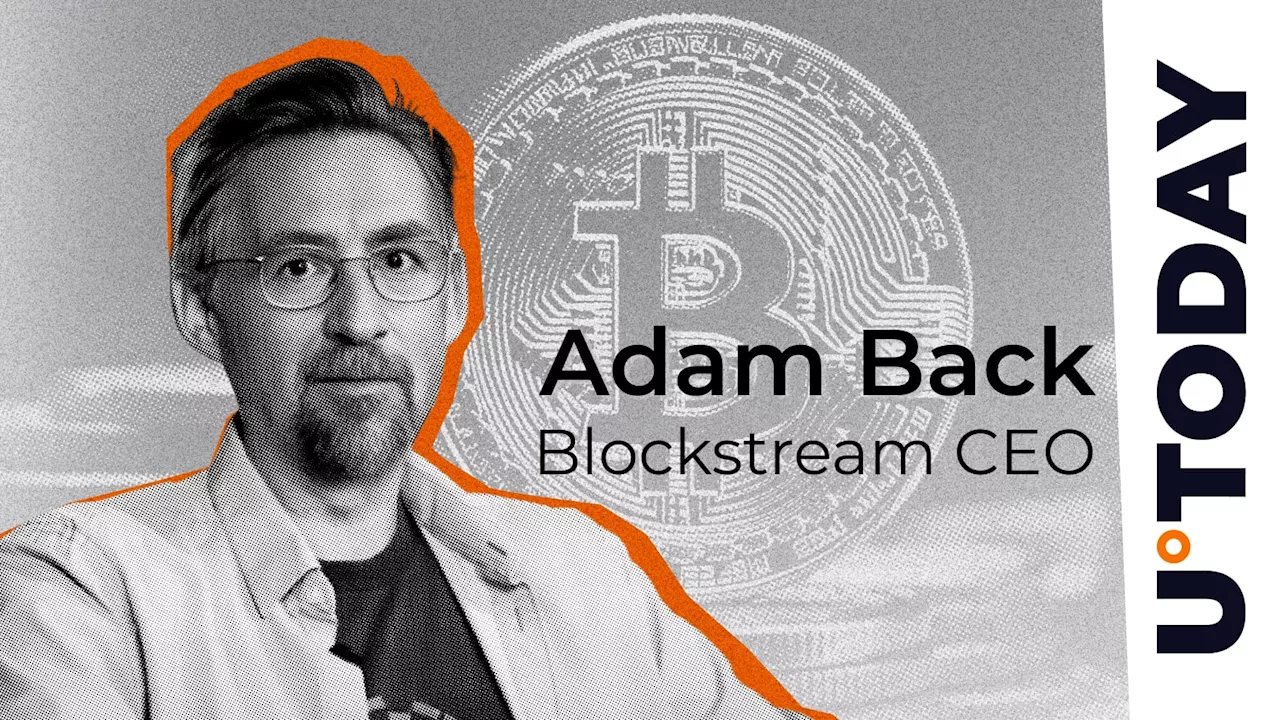

Recent discussions surrounding the potential impact of quantum computing on Bitcoin’s security have sparked significant debate. Adam Back, a notable figure in the cryptocurrency community, has taken a stand to clarify misconceptions related to these fears. He emphasizes that Bitcoin’s security fundamentally relies on digital signatures rather than traditional encryption methods, debunking claims that a quantum threat is imminent or straightforward.

Concerns have been raised by writers such as Josh Otten, who argued that a quantum computer could potentially exploit Shor’s algorithm to compromise the encryption safeguarding Bitcoin’s earliest wallets. Otten posited that this could lead to the exposure of private keys associated with Satoshi Nakamoto’s fortune, resulting in a catastrophic market crash and a loss of trust in the entire cryptocurrency ecosystem. He suggested that such a scenario could drive Bitcoin’s value to nearly zero in a remarkably short timeframe.

Despite these alarming predictions, Back asserts that Bitcoin wallets utilize elliptic curve cryptography, specifically the secp256k1 curve, for transaction signing. This approach employs private keys to authenticate transactions, while public keys and addresses facilitate verification. It is crucial to note that this process differs from data encryption, which involves concealing information that can later be decrypted.

While a sufficiently advanced quantum computer could theoretically use Shor’s algorithm to derive private keys from public keys, the current system offers safeguards. For instance, Bitcoin addresses do not reveal their public keys unless a transaction is made. Therefore, early Bitcoin wallets that have never been used remain secure from such attacks.

The co-founder of Solana, Anatoly Yakovenko, estimated a 50/50 chance that quantum technology could pose a threat to Bitcoin’s cryptography within the next five years. In contrast, Back indicated that a meaningful threat from quantum computing is unlikely for another 20 to 40 years. He pointed out that even the most advanced quantum systems today still lack the error-corrected logical qubits necessary to run Shor’s algorithm at scale effectively.

Moreover, advancements in post-quantum cryptography are already in development, which could further bolster Bitcoin’s defenses against future quantum threats. As the technology evolves, the cryptocurrency community remains engaged in discussions about how to adapt and protect digital assets.

In summary, while fears regarding quantum computing and its implications for Bitcoin’s security persist, experts like Back stress the importance of understanding the underlying technology and its current resilience. As the landscape continues to change, ongoing dialogue will be vital in addressing these concerns and ensuring the integrity of cryptocurrencies.