UPDATE: Central banks are urgently re-evaluating their currency strategies, with many now investing heavily in gold as concerns over fiat currencies grow. This significant shift comes as the value of the U.S. dollar has depreciated by a staggering 99 percent against gold since the Bretton Woods era.

Recent reports reveal a renewed interest in gold among central banks globally, marking a dramatic turn from previous sentiments that deemed gold an outdated asset. Instead, central banks are increasing their gold reserves, with the unrealized profit of the U.S. Treasury on its gold holdings reaching approximately $1 trillion. This comes amidst a backdrop where the Federal Reserve has reported operating losses exceeding $1 trillion, emphasizing the urgent need for a stable reserve asset.

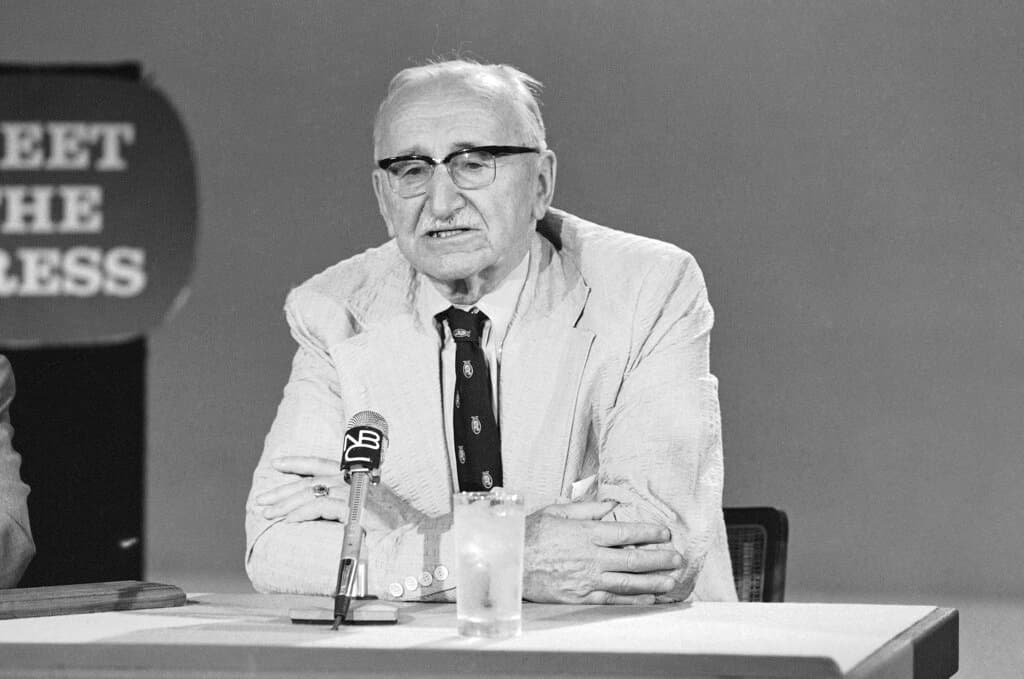

The discussion echoes themes from economist Friedrich Hayek, who argued that government monopolies on currency lead to depreciation and loss of purchasing power. In his influential essay, “Choice in Currency,” Hayek posited that removing this monopoly could foster competition and improve currency stability.

“Practically all governments of history have used their exclusive power to issue money in order to defraud and plunder the people,” Hayek stated, highlighting the potential dangers of unchecked monetary authority. His advocacy for currency competition is becoming increasingly relevant as central banks reassess their strategies in a rapidly changing economic landscape.

The implications of this shift are profound. As more central banks turn to gold, the question arises: will this lead to a new era of currency competition? Countries are already feeling the pressures of inflation and currency depreciation, making the stability offered by gold more appealing than ever.

Historically, the U.S. dollar was viewed as synonymous with gold, a perspective championed by Harry Dexter White during the 1944 Bretton Woods Conference. However, the current reality starkly contrasts this earlier confidence, as the dollar’s value has plummeted. The previous Bretton Woods price of 28.6 ounces of gold per dollar is now a distant memory, with the dollar currently trading at about one-quarter of an ounce of gold.

As the international market for central bank reserves evolves, the dynamics of currency competition may indeed reflect Hayek’s vision. The growing demand for gold suggests that the asset is reclaiming its status as a reliable store of value, challenging the traditional dominance of fiat currencies.

This shift marks a pivotal moment for financial markets, prompting investors and policymakers alike to reconsider their strategies. As central banks worldwide navigate these turbulent economic waters, the spotlight is now firmly on gold as a potential hedge against the uncertainties of fiat currency systems.

Stay tuned for further updates as this story develops. With central banks increasingly looking to gold, the future of currency may be at a crossroads, and the implications for economies worldwide could be significant.