The cryptocurrency market is buzzing with anticipation as analysts predict a significant price rally for Cardano (ADA). Many experts are now suggesting that ADA could reach a target of $2.50 if current bullish trends continue. This optimism comes amid increasing investor interest in layer-2 alternatives to Ethereum, positioning Cardano as a compelling option for those looking to capitalize on the next wave of digital currency growth.

Cardano is showing promising signs for a potential breakout. The Cardano Foundation recently announced plans to apply for generic top-level domains (gTLDs) such as “.ada” and “.cardano,” which could further legitimize the project in the eyes of investors. Analysts have identified bullish breakout patterns and noted the formation of golden crosses, which historically precede price surges in the cryptocurrency market. Some analysts project a near-term target of around $2.30, leveraging the momentum from recent developments.

As the current price remains substantially lower than these projections, the narrative of significant upside potential is gaining traction. Traders are observing an uptick in open interest in futures markets, indicating that substantial capital is flowing into ADA. This influx is a positive signal for those tracking high-growth cryptocurrencies. Additionally, on-chain accumulation by large holders adds further weight to the bullish case for Cardano.

Market Perspectives and Resistance Levels

Despite the optimism, contrasting voices have emerged regarding potential risks. Some models indicate that if key support levels fail, ADA could experience pullbacks. Nevertheless, discussions among early investors reflect a strong belief in the possibility of a 2-4x rally from current levels. Analysts have pointed out critical resistance zones around $1.10-$1.40, which, if surpassed, might pave the way for a significant move toward the $2.50 target.

Many investors are already experiencing gains and are eager not to miss out on what could be the next upward trend. The current sentiment suggests that those positioning themselves in the market now may benefit from a potential surge, as fear of missing out (FOMO) drives interest.

Emerging Contender: Remittix

In the broader context of decentralized finance (DeFi) projects, another player is quietly gaining attention: Remittix. This emerging platform has secured over $27.7 million in private funding and is developing a cross-chain payments protocol aimed at real-world applications. When compared to established cryptocurrencies like Cardano, Remittix presents a compelling alternative with its focus on rapid settlement and fiat bridge functionality.

While Cardano boasts a robust ecosystem and brand recognition, Remittix is carving out a niche in payments and liquidity, promising genuine utility and a growing community. As the range of low gas fee cryptocurrency solutions expands, Remittix combines payments, DeFi, and global reach—an advantageous trio in today’s market.

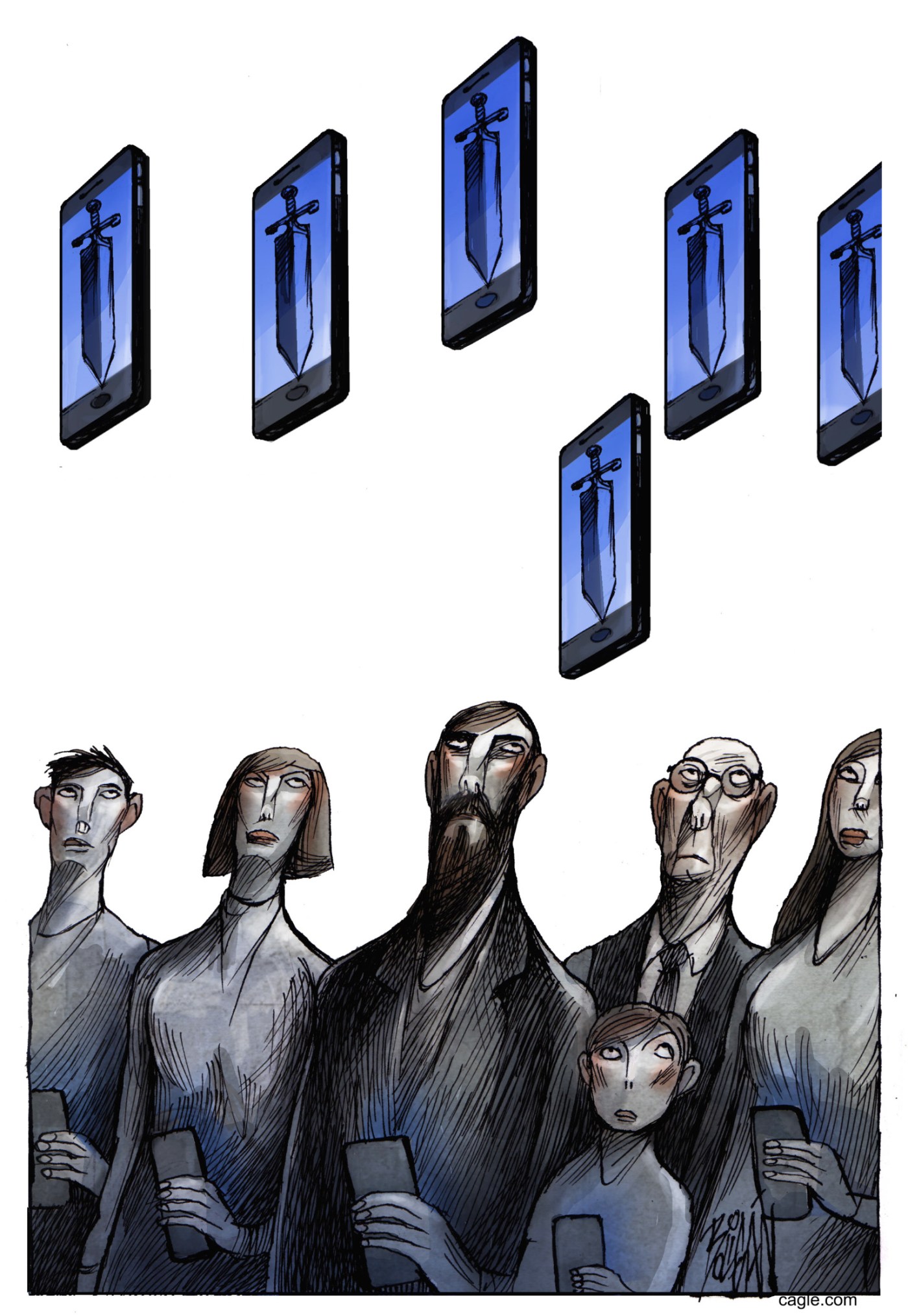

As Cardano continues to capture investor interest with its potential for growth, the presence of innovative projects like Remittix highlights the dynamic landscape of the cryptocurrency sector. Investors are encouraged to stay informed and conduct thorough research, as the financial risks associated with cryptocurrencies remain significant.

In summary, as Cardano positions itself for a potential rally towards $2.50, the cryptocurrency market remains vibrant with opportunities. Investors are urged to consider both established and emerging projects as they navigate this rapidly evolving environment.