UPDATE: The European Central Bank’s (ECB) official, Kazaks, has just announced that the next interest rate move could very well be a hike, sparking immediate reactions in the foreign exchange markets. As the U.S. trading session unfolds, the EURUSD pair has surged, erasing earlier declines and indicating a potential shift in market sentiment.

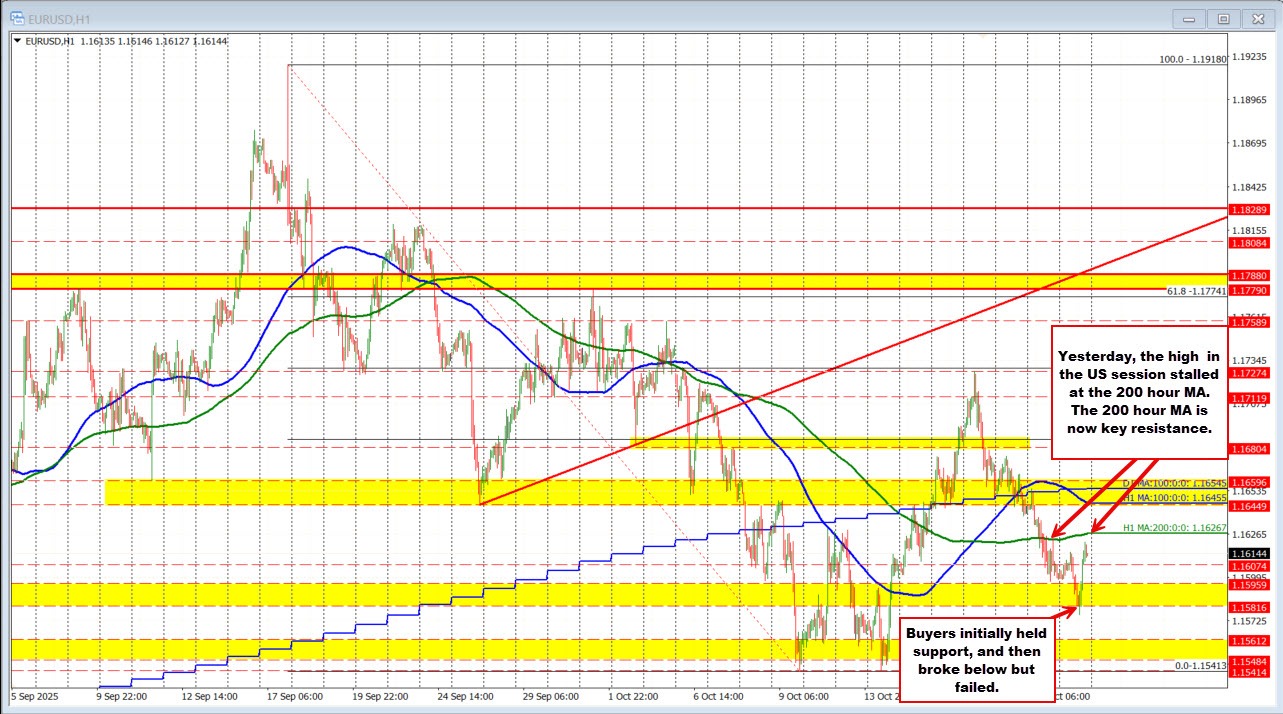

Earlier today, the EURUSD dipped below a critical swing area, reaching a session low of 1.1578. However, this downward movement quickly lost momentum as the pair reclaimed its support zone between 1.1581 and 1.15956. This recovery prompted sellers to cover their positions, fueling a rally during the New York morning. As momentum built, the pair soared above the previous session high of 1.1615, peaking at 1.1622.

This rally brings the EURUSD within striking distance of the 200-hour moving average, currently positioned at 1.16267. A sustained break above this pivotal level could significantly enhance buyers’ control, shifting the short-term bias toward the upside. Conversely, if the price fails to hold above the 1.1615 to 1.1622 range, traders may see the pair retreat back to the 1.1595 to 1.1580 support zone, where buying interest has recently emerged.

The stakes are high as traders focus on the critical level of 1.1627. A decisive break above this threshold would strengthen the bullish narrative, while failure to do so risks reestablishing the broader consolidation trend observed over recent sessions.

Kazaks’ comments come at a pivotal time, as market participants closely monitor potential changes in ECB policy that could have far-reaching implications for the Eurozone economy. The urgency in the market reflects a growing anticipation of upcoming economic data and central bank decisions.

For those watching the forex markets, the developments surrounding the EURUSD are crucial. The potential for a rate hike from the ECB could reshape the landscape, influencing trade strategies and investment decisions. Market watchers should remain alert for further updates as this story develops.

Stay tuned for more updates as we monitor the evolving situation surrounding the ECB and the foreign exchange markets.