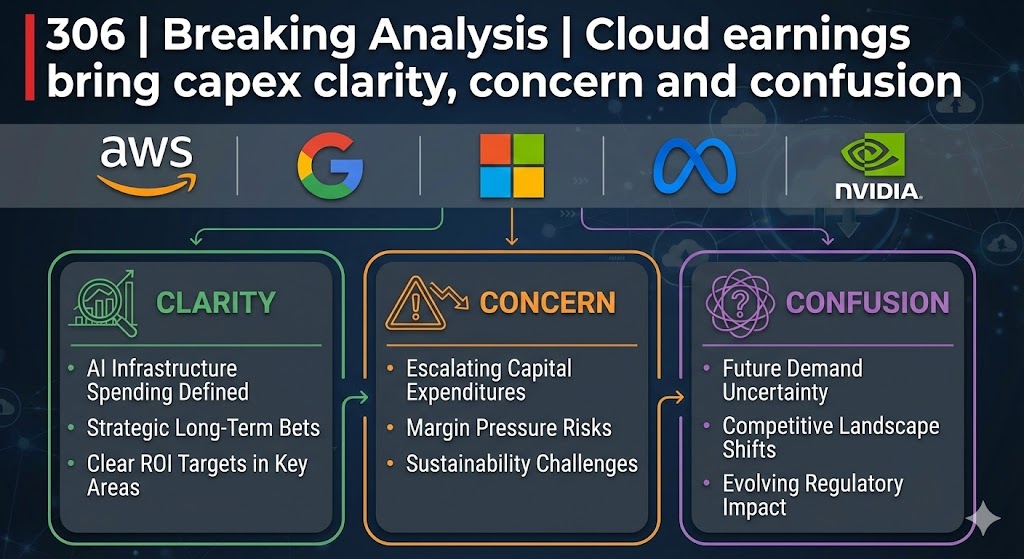

This winter, major technology firms including Meta Platforms Inc., Microsoft Corp., Alphabet Inc., and Amazon.com Inc. revealed plans to significantly increase their capital expenditures (capex) for 2026, collectively exceeding $615 billion. This figure represents a remarkable 70% increase compared to the already substantial spending in 2025. While demand for artificial intelligence and computing solutions remains robust, the aggressive spending raises concerns among investors regarding the uncertain returns on these investments.

During the earnings calls, executives from these companies projected that an estimated 60% of the capital dedicated to artificial intelligence initiatives would flow to Nvidia Corp., a detail that many investors seemed to overlook. Following these announcements, stocks in the sector experienced a downturn, although a recovery was noted on Friday after a week of losses.

Market analysts have been closely examining the commentary from company leadership regarding this spending surge. Notably, Amazon forecasted a capex of $200 billion for the year, contributing to a decline in its stock price amid a conservative outlook. Google is also expected to invest over $175 billion in capital expenditures. Meanwhile, Microsoft reported an increase in capex, but its Azure growth fell short of expectations, leading to further market skepticism about the timing of returns on such large investments.

Despite these concerns, experts suggest that the current capex cycle is a necessary precursor to a broader buildout in cloud and AI capabilities. This situation prompts two critical questions: how long it will take for these infrastructures to be operational and whether they will translate into significant revenue growth. Microsoft’s recent experience serves as a cautionary tale, as its Azure division’s slower growth has drawn scrutiny from investors who expected closer alignment between spending and revenue growth.

The narrative within the market has shifted from “AI is the future” to a more pressing demand for tangible returns. As Amazon Web Services (AWS) reported a stronger-than-expected quarter, achieving a run rate of $142 billion with 24% year-on-year growth, it sets a benchmark for how investors interpret the ambitious capex estimates. Andy Jassy, AWS Chief Executive, noted that growing from a substantial base presents different challenges than achieving growth from a smaller one.

The conversation around AI adoption and cloud migration continues to evolve. Jassy emphasized that successful AI implementation necessitates cloud integration, reinforcing the idea that AI is more than just an additional workload; it is a catalyst for transforming data management practices. Companies are increasingly focusing on using their data earlier in the AI lifecycle, rather than waiting for perfect conditions.

On the silicon front, Jassy highlighted AWS’s significant investments in its chip business, claiming a run rate of $10 billion. AWS is notably expanding its core compute capabilities, utilizing its Graviton chips, which are reported to outperform traditional processors. However, the competitive landscape remains challenging, particularly as Nvidia continues to lead in terms of volume and technological advancement.

In contrast, Sundar Pichai of Google provided insights into the demand dynamics shaped by AI-powered search experiences. He noted that users are engaging with new AI features at unprecedented rates, which has implications for Google’s infrastructure plans. Pichai reiterated the importance of both Nvidia GPUs and Google’s proprietary TPUs, highlighting the company’s reliance on Nvidia’s technology to maintain its competitive edge.

As the cloud and AI markets evolve, both Amazon and Google are navigating a landscape marked by increasing demand and higher operational costs. The shift in user behavior towards AI-intensive interactions raises questions about profitability and the sustainability of current business models. Google reported a 48% increase in cloud revenue, reaching $17.7 billion, with an operating margin of 30.1%.

Looking ahead, the competitive landscape among major cloud providers is tightening. While AWS remains the leading platform, evidence suggests that Azure has made significant inroads, adding more incremental revenue than AWS during the past year. This challenges previous assumptions about the relative scale and growth potential of these platforms.

In summary, the significant increase in capex by these tech giants signals an aggressive strategy to capture the burgeoning AI and cloud markets. Despite the immediate concerns over spending and returns, the long-term implications of this investment could shape the future landscape of technology infrastructure. As the industry continues to evolve, the interplay between innovation, demand, and competitive dynamics will remain a focal point for investors and stakeholders alike.