UPDATE: South Dakota lawmakers have launched an ambitious initiative to tackle the state’s escalating property tax crisis, introducing at least 28 bills aimed at providing immediate relief. As the legislative session kicks off this month and runs until March 2024, the urgency is palpable as homeowners face nearly a 70% increase in property taxes over the past decade.

The proposals come on the heels of recommendations from the Legislature’s Comprehensive Property Tax Task Force, which suggested 19 measures in October. Governor Larry Rhoden is backing a pivotal bill that would allow counties to implement a 0.5% sales tax to funnel revenue into property tax relief efforts.

Democratic leaders are also preparing to present their own proposals soon, signaling a growing consensus on the need for change. Senate Assistant Majority Leader Carl Perry of Aberdeen characterized past attempts to reduce property taxes as a “game of Whack-A-Mole,” highlighting the numerous challenges legislators face in achieving a balanced solution.

“It’s going to be tough to get things exactly right, but we’re going to work at it,” Perry stated, emphasizing the necessity for collaboration among lawmakers.

The implications of these proposals are significant. With state government primarily funded by sales taxes, counties and schools heavily depend on property tax revenues. The pressure to alleviate the burden on homeowners is intensifying, especially as cities are experiencing rapid growth that further complicates tax structures.

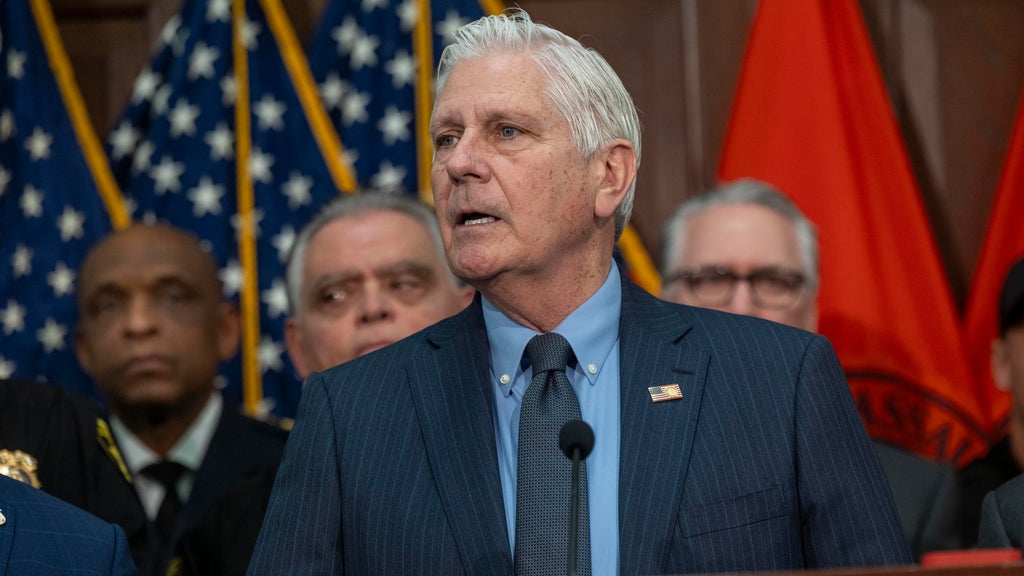

One notable proposal from U.S. Representative Dusty Johnson aims to utilize revenues from an upcoming increase in the sales tax rate, which was reduced from 4.5% to 4.2% in 2023 but is set to revert in 2027. Senate President Pro Tempore Chris Karr has introduced legislation to maintain the sales tax rate at its current level, warning that increasing the rate could exacerbate the financial strain on taxpayers already grappling with high property taxes.

Karr compared the use of sales taxes to provide property tax relief to a feudal system, stating, “No matter how bad we want property tax relief, that’s not right.” This reflects the growing complexity and emotional weight of the issue as citizens call for fair and effective solutions.

Last year, lawmakers adopted comprehensive relief measures that capped assessment growth for five years, exempted certain home improvements from tax assessments, and expanded eligibility for relief programs aimed at disabled and elderly residents. However, challenges remain. Senator Randy Deibert has introduced a bill to increase the cap on new construction and growth from 3% to 5%, addressing concerns from communities that feel constrained by current limitations.

During a recent Senate Taxation Committee hearing, Heath VonEye, deputy city administrator for Harrisburg, warned that the existing cap could lead to a revenue shortfall of nearly $3 million if growth continues at its current rate. “The costs of paying for infrastructure and services get pushed onto existing homeowners,” VonEye explained, highlighting the urgent need for legislative action.

Several other significant bills are currently making their way through the legislative process, including:

– **Senate Bill 85**: Requires elections for schools to exceed property tax limits.

– **House Bill 1168**: Provides a property tax credit for private school or homeschool expenses.

– **Senate Bill 20**: Appropriates $425,000 for property and sales tax refunds for low-income elderly or disabled residents.

Moreover, there are bills proposing constitutional amendments to cap annual property tax increases and establish new property tax relief funds, showcasing a comprehensive approach to the issue.

While the session is still in its early stages, the breadth of proposals reflects a critical moment for South Dakota’s policymakers. Lawmakers are keenly aware that the decisions made in the coming weeks will have lasting impacts on communities across the state.

As the session unfolds, the pressure is on for legislators to find common ground and deliver meaningful relief to those impacted by rising property taxes. The situation remains fluid, and stakeholders are encouraged to stay informed as developments continue.

Residents and officials alike are watching closely, as the outcome of these discussions could determine the trajectory of property tax policies in South Dakota for years to come.