Comcast (NASDAQ:CMCSA) has entered a potentially challenging trading environment following the recent spin-off of Versant Media Group, which is now a separate publicly traded entity. This transition has generated initial interest among investors, but a deeper analysis indicates that the stock’s potential for significant upward movement may be limited in the near term.

Understanding Comcast’s Current Market Position

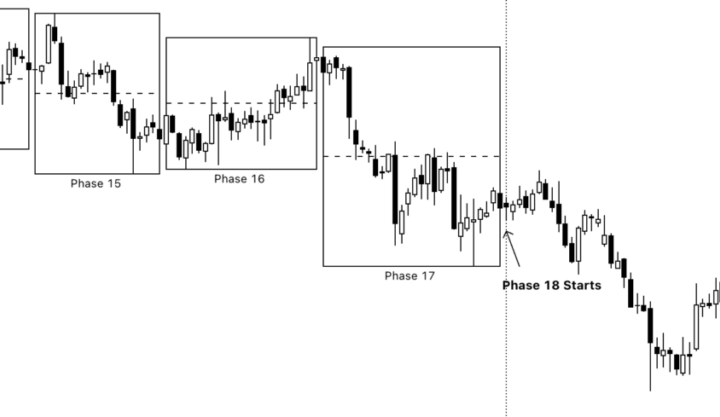

To comprehend the future trajectory of Comcast’s stock, it is essential to evaluate its performance during the previous phases of the Adhishthana cycle. The company is currently in Phase 18, which follows the Guna Triads formed during Phases 14, 15, and 16. According to the Adhishthana framework, these phases are crucial for determining whether the stock can achieve a “Nirvana move” in Phase 18, which represents the peak of the cycle. For such a move to occur, the triads need to demonstrate a strong bullish structure, known as Satoguna.

As discussed in detail in my publication, Adhishthana: The Principles That Govern Wealth, Time & Tragedy, “Without noticeable Satoguna in any of the triads, no Nirvana can emerge in Phase 18.” Unfortunately for Comcast, the stock has not exhibited the necessary bullish momentum since entering its triads in July 2023. Phase 16 concluded in November 2024, and throughout this period, the stock has struggled to show any significant upward movement, leading to a lack of structural strength.

Nearly halfway through Phase 18, Comcast shares have faced a notable decline, dropping more than 29% from their recent highs. Although the spin-off of Versant Media Group has provided some stabilization, the overall structural setup indicates that any recovery may not be sustainable.

Investor Sentiment and Future Outlook

Given the weak performance of the previous triads, analysts believe that Comcast is unlikely to experience a strong upward trajectory as it progresses through Phase 18. Instead, the stock is projected to trade in a volatile, range-bound manner, where any short-term rallies may prove difficult to maintain.

This outlook does not suggest an aggressive downturn from current levels, but it does indicate that the risk-reward profile for new long positions remains unfavorable. Investors are advised to exercise caution and may find it beneficial to wait for the cycle to reset before reevaluating Comcast’s long-term growth potential.

For the time being, Comcast appears to be more suited for range-based strategies rather than aggressive bullish positioning. The current environment underscores the importance of strategic planning and careful analysis in navigating the complexities of the stock market.