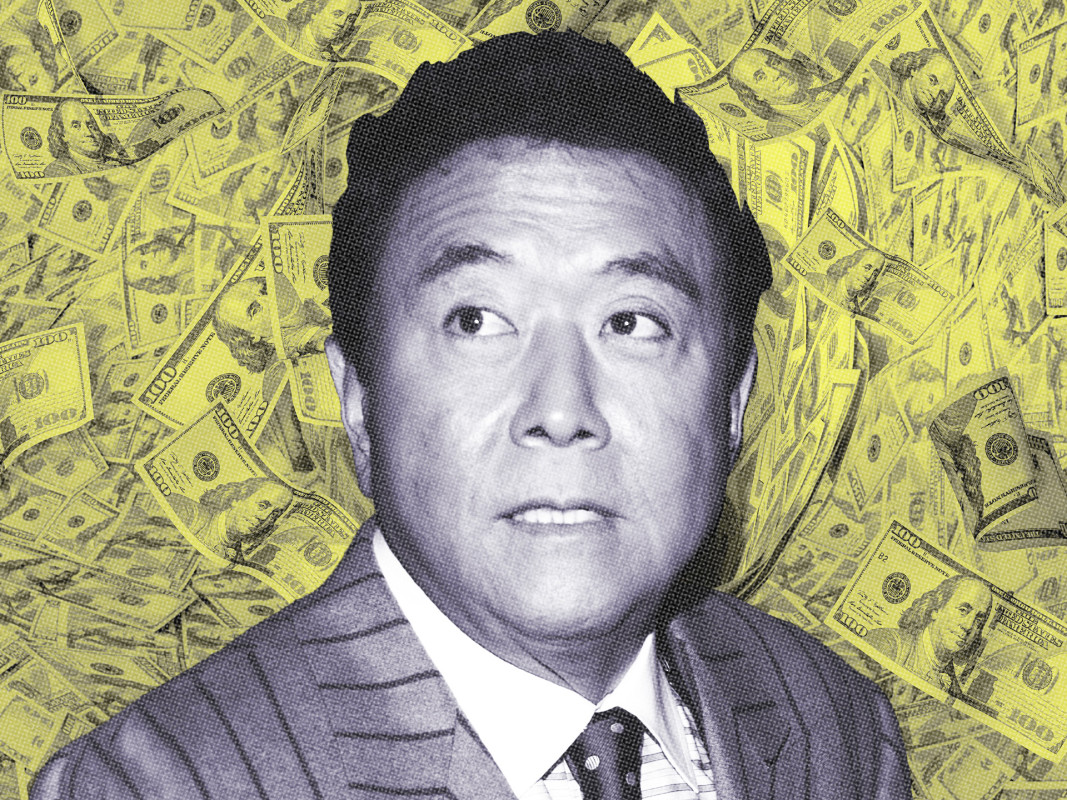

Robert Kiyosaki, the author of *Rich Dad Poor Dad* and financial educator, has stirred significant attention with a bold prediction for the future price of gold. In a recent post on X, he stated, “GOLD soars over $5000. Yay!!!! Future for gold $27,000,” as gold futures opened at approximately $5,013 per ounce on January 26, 2024. This marked a notable rise of around 0.7% from the previous Friday and represented the first time gold prices surpassed the $5,000 threshold.

As gold prices climbed to about $5,090 per ounce, driven by increased safe-haven demand and expectations for possible interest rate cuts, Kiyosaki’s long-term target captured the attention of traders and analysts alike. His projection implies a fivefold increase from the current levels, raising questions about whether his forecast reflects genuine market insight or merely sensationalism.

Kiyosaki has consistently voiced his views on impending economic turmoil, frequently discussing what he terms an “everything crash.” He has publicly advocated for investing in tangible assets, such as gold and cryptocurrencies, rather than traditional paper assets. In previous statements, he set ambitious targets for gold at $27,000, silver at $100, and Bitcoin at $250,000 by 2026. These figures stem from his belief that fiat currencies are undergoing a process of debasement, which he argues will lead to a substantial reevaluation of real assets.

The timing of Kiyosaki’s recent comments coincides with escalating market uncertainty. His statement suggests that he views the current rally in gold prices as indicative of a larger trend, where fiat currencies are losing purchasing power, making gold, silver, and cryptocurrencies more attractive investments. Observers note that his prediction resonates with many investors who are increasingly concerned about rising costs of living and inflation.

Kiyosaki’s Predictions Compared to Wall Street Forecasts

To put Kiyosaki’s forecast into perspective, it is essential to compare it to mainstream financial predictions. Recently, Goldman Sachs raised its year-end 2026 target for gold to $5,400 per ounce, up from a previous estimate of $4,900. This adjustment reflects the bank’s view of persistent demand for gold as a hedge against macroeconomic risks.

Kiyosaki’s target seems vastly more optimistic when juxtaposed with these mainstream figures. His projection suggests a significant shift in market dynamics—one that would require a crisis of confidence in fiat currencies rather than merely a continuation of current economic trends. Analysts generally predict more conservative increases in gold prices, with most major banks setting targets that are a few hundred dollars above current levels.

The recent performance of gold futures indicates a strong rally, gaining over 80% in the past year, marking the best annual performance in decades. This surge can be attributed to robust central bank buying, increased inflows into exchange-traded funds (ETFs), and ongoing geopolitical tensions. Such factors suggest that the demand for gold is not just a fleeting trend but rather a sustained response to economic instability.

Market Conditions Favoring Gold Investment

Kiyosaki’s declaration has gained traction against a backdrop of favorable market conditions for gold. As global conflicts and elections multiply, institutional demand for safe-haven assets has surged. Additionally, expectations for interest rate cuts have made non-yielding assets like gold increasingly appealing.

Observers have noted that Kiyosaki’s views reflect a narrative shared by many retail investors who are dissatisfied with rising living costs and stagnant wages. His assertion that “this rally of gold is not over yet” aligns with the sentiment that many investors are seeking protection against inflation and economic uncertainty.

While Kiyosaki’s predictions may seem extreme, they compel individuals to reevaluate their investment strategies. His forecasts serve as a reminder to consider the potential risks and rewards associated with investing in hard assets during times of economic volatility.

For investors contemplating their portfolios, Kiyosaki’s statement raises important questions about their long-term strategies. Are they prepared for a potential crisis, and how much exposure do they have to gold and other tangible assets? As the debate over the future of gold continues, Kiyosaki’s target of $27,000 serves as a provocative benchmark in a landscape filled with uncertainty.