Stagnating economies burdened by high government debt are pushing the US, UK, and Eurozone into potential funding crises. The situation raises critical questions about which economy will falter first under the weight of its financial obligations. Alasdair Macleod, writing for VonGreyerz.gold, outlines the mechanics of these debt traps and the implications of rising interest rates amid economic stagnation.

Understanding the interconnectedness of debt and credit is essential as governments grapple with fiscal challenges. When economies slow down, banks often redirect their assets from private sector loans to government debt, perceived as a safer investment. Despite this shift, confidence in government debt is waning, with many economies now facing scrutiny over their financial strategies.

The debt situation in advanced economies, particularly in the Eurozone and the UK, is precarious. With insufficient growth to support massive government debts, the potential for a crisis looms large. Macleod recalls the infamous 1976 sterling crisis, when the IMF intervened to bail out the British government. He questions whether a similar scenario is on the horizon for the US or EU, emphasizing that markets may force fiscal discipline, particularly on the edge of a recession.

The debt-to-GDP ratios of the G7 nations are concerning. A critical factor influencing these ratios is the difference between tax revenue growth and debt growth. Historically, governments have managed to reduce their debt-to-GDP ratios after significant events, such as World War II. For example, in 1946, the US government debt peaked at 120% of GDP and gradually fell to 35% by 1971. This decline was facilitated by strong GDP growth outpacing debt growth, a feat that seems increasingly difficult in today’s economic landscape.

Currently, the situation is markedly different. The gross debt in the US has been increasing at a rate nearly three times faster than GDP growth, particularly exacerbated since the 2020 pandemic. Foreign central banks are increasingly wary, shifting their investments from US dollars to gold, which highlights a growing loss of confidence in the dollar’s stability.

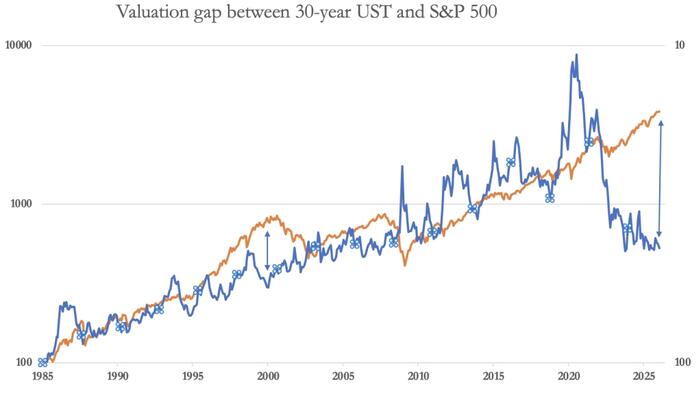

High interest rates pose an additional threat to government finances. After a period of suppressed rates, the recent increase in interest rates and bond yields has placed further strain on government budgets. The US government has relied heavily on foreign investment in its Treasury debt, but that demand is waning. This shift could lead to a funding crisis, as foreign investors become reluctant to purchase long-term Treasuries, causing the US Treasury to rely more on short-term T-bills.

The implications of a debt trap extend beyond government finances to the broader economy. As interest costs rise, the attractiveness of equities diminishes, leading to potential market corrections. The disparity between returns on long-term bonds and equities is at an all-time high, indicating that a significant market downturn could be imminent. In this context, the rising price of gold reflects a growing lack of confidence in the dollar as a stable currency.

The current trajectory suggests that without significant intervention or changes in fiscal policy, the US, UK, and Eurozone may face critical financial challenges. As governments navigate these turbulent waters, the question remains: who will be the first to seek a bailout, and what measures will be taken to address these mounting debts? The markets will likely dictate the outcomes as they respond to the evolving economic landscape.