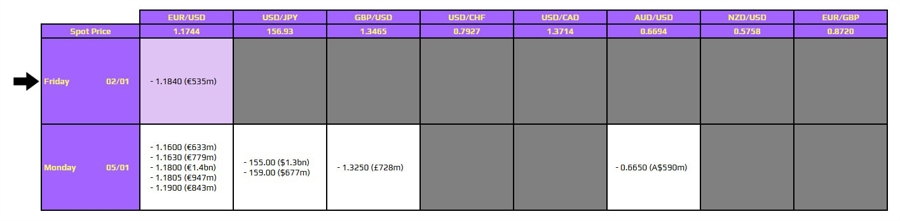

UPDATE: FX option expiries for January 2 at 10 AM New York time are signaling a slow start to the trading year as market activity remains subdued. Many traders are still away, leading to a lack of major expiries and limited interest in foreign exchange markets.

As markets remain sidelined following the holiday break, liquidity is expected to gradually improve next week. Current trading dynamics show that January 2 will not see significant expiries, emphasizing the need for traders to keep an eye on positioning flows as they begin 2026.

Market focus is shifting towards precious metals, with gold rallying 1.5% to $4,378 and silver surging 3.9% to approximately $74.05. This renewed interest in precious metals is set to captivate traders as they look for signs of momentum in the coming days.

Authorities and market analysts suggest that while today may lack notable expiries, the upcoming week promises to bring more movement as participants return to the market. Traders should prepare for potential shifts in positioning as liquidity returns and interest begins to rise.

For those eager to stay informed, accessing insights from InvestingLive (formerly known as ForexLive) can provide valuable data and analysis as the market landscape evolves. Stay tuned for further updates as we navigate the early days of the new trading year.