As students return from winter break, many are encouraged to use this time to tackle the crucial task of completing the Free Application for Federal Student Aid (FAFSA). With college tuition costs steadily increasing, families are feeling the financial strain, leading to a national student debt crisis that has reached nearly $2 trillion.

Dr. Shaan Patel, Founder and CEO of Prep Expert, emphasizes the importance of exploring diverse funding options for higher education. “College is becoming extremely expensive for families as tuition continues to skyrocket,” he states. He advises all families, regardless of income, to fill out the FAFSA application, noting that some merit-based scholarships require this form to determine eligibility.

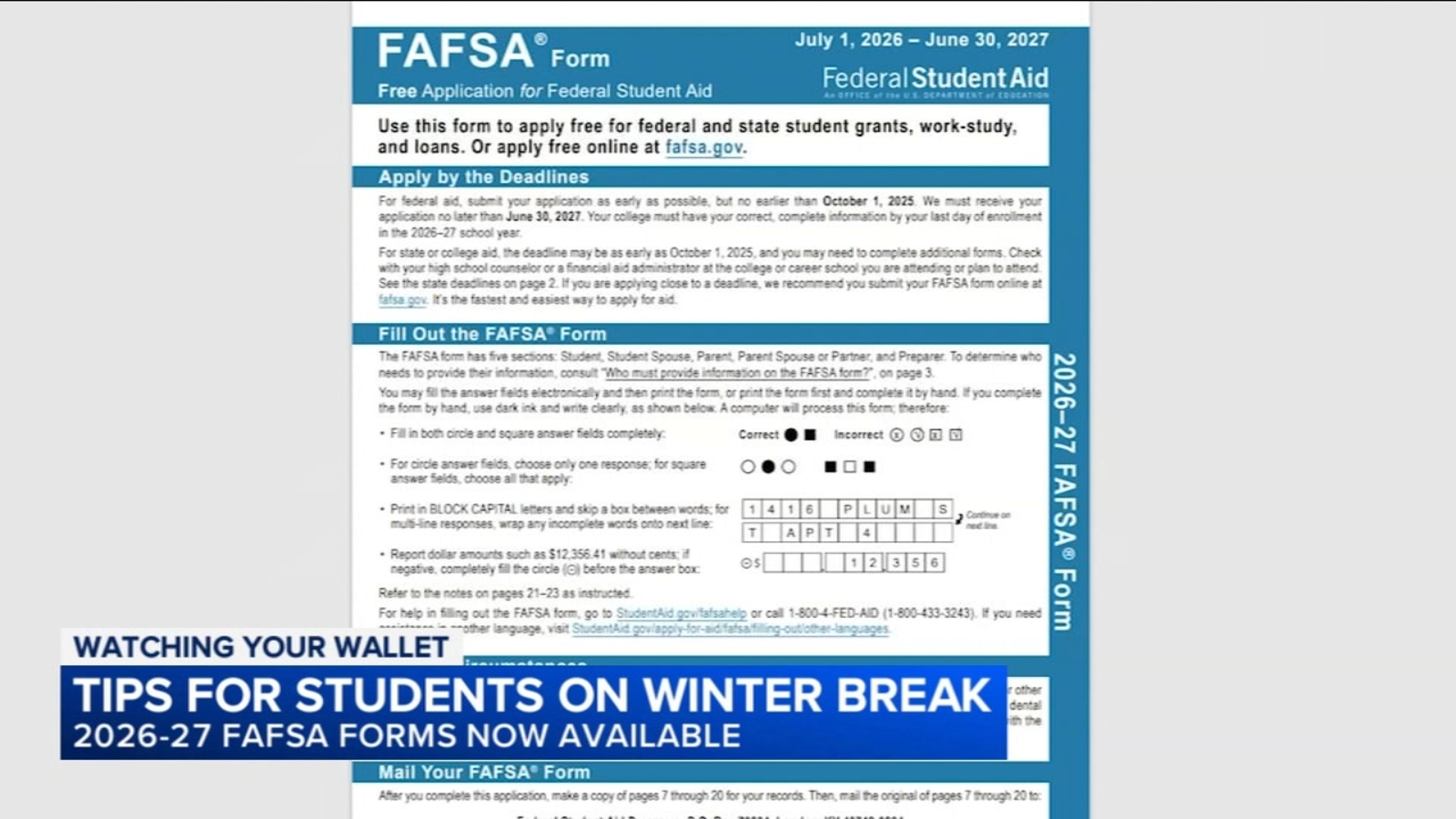

Streamlined FAFSA Process for 2026-27

The FAFSA for the 2026-27 academic year is currently available and features a streamlined application process. Dr. Patel highlights that the new form is quicker to fill out, as it allows users to integrate tax information directly from the IRS website.

Despite the simplification, there are common pitfalls to avoid. Dr. Patel identifies a critical mistake: families often let students attempt to complete the FAFSA independently. “It’s just not possible,” he warns, suggesting that families should collaborate during this process. He recommends setting aside three to four hours during winter break to work together on the application.

Essential Documents and Timeliness

To ensure a smooth application process, Dr. Patel advises families to gather necessary documents beforehand. This includes social security numbers, tax documents, bank account statements, and brokerage statements. “All of that will be needed to input into the FAFSA application,” he states.

Timing is crucial when it comes to financial aid. “The earlier you get it in, the earlier you’ll be considered for financial aid awards at many colleges and institutions,” Dr. Patel explains. Some institutions offer financial aid on a rolling basis, making early submission advantageous.

With the cost of higher education continuing to rise, taking proactive steps can significantly impact a student’s financial future. Completing the FAFSA is a vital first step in securing the necessary funding for college. Families are encouraged to start this process now to maximize their opportunities for assistance.