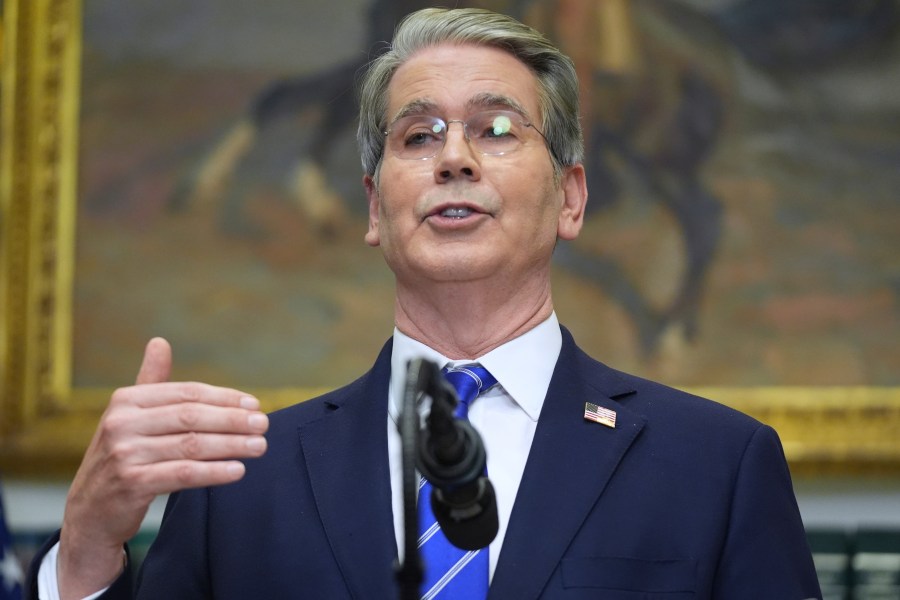

The U.S. Treasury Department is intensifying its investigations into potential fraud involving businesses that facilitate money transfers for Minnesota’s Somali community. Treasury Secretary Scott Bessent announced the initiative on Friday, highlighting the government’s focus on financial activities linked to the diaspora. This move follows a broader strategy by the Trump administration to scrutinize immigration patterns and financial transactions related to this community.

The investigations are primarily aimed at businesses that enable individuals to wire money to family members abroad. These remittances are crucial for many families, providing essential support to those living in Somalia. The Treasury’s increased scrutiny raises concerns about the potential impact on financial services that serve the community.

The actions against Minnesota’s Somali population come amidst a series of immigration enforcement initiatives launched by President Donald Trump. This administration has placed a particular emphasis on the Somali diaspora, resulting in a climate of heightened anxiety within the community. Many are worried that these investigations could lead to further legal repercussions and a chilling effect on financial transactions that are critical for their survival.

As part of the new investigations, the Treasury has begun examining various aspects of the remittance businesses, including their compliance with federal regulations. Businesses that fail to adhere to these rules may face significant penalties. The Treasury’s actions reflect a broader concern about the potential misuse of remittance services and the need to ensure that these transactions are not being exploited for illegal activities.

Community advocates have expressed alarm over the implications of these investigations. They argue that targeting Somali businesses could undermine the trust that many families place in these essential financial services. The Somali community in Minnesota, one of the largest in the United States, has long relied on remittances to support relatives back home, particularly in areas experiencing economic hardship.

The Treasury Department’s emphasis on fraud detection aligns with its broader mandate to ensure the integrity of the financial system. However, critics of the initiative argue that it may inadvertently penalize legitimate businesses and families who rely on these services for their daily needs. The ongoing investigations could lead to more stringent regulations that might restrict access to vital financial resources for the community.

As the situation develops, many will be watching closely to see how these investigations unfold and the potential ramifications for Minnesota’s Somali population. The balance between ensuring financial compliance and safeguarding the livelihoods of families remains a delicate issue amid a politically charged environment.