Recent financial analyses highlight a significant comparison between two medical companies: CarePayment Technologies and Sera Prognostics. The evaluation focuses on various factors, including valuation, profitability, and analyst recommendations, to determine which company may offer a better investment opportunity.

Analysts from MarketBeat indicate that CarePayment Technologies presents a more favorable outlook than Sera Prognostics due to its higher potential upside. This assessment suggests that investors may find CarePayment Technologies to be a more attractive option moving forward.

In terms of earnings, CarePayment Technologies has reported lower revenue compared to Sera Prognostics, yet it boasts higher earnings. This discrepancy raises questions about the sustainability and growth potential of each company within their respective markets.

Institutional ownership reflects confidence in a company’s long-term viability. Currently, 54.6% of Sera Prognostics shares are held by institutional investors, while insider ownership stands at 13.5%. In contrast, CarePayment Technologies has 13.9% of its shares owned by insiders. The stronger institutional backing for Sera Prognostics suggests a belief among large investors in its future growth.

Profitability metrics further differentiate the two companies. A comparative analysis of net margins, return on equity, and return on assets indicates that CarePayment Technologies outperforms Sera Prognostics on five of the eight evaluated factors. This data underscores the varying financial health of the two firms.

### Company Profiles

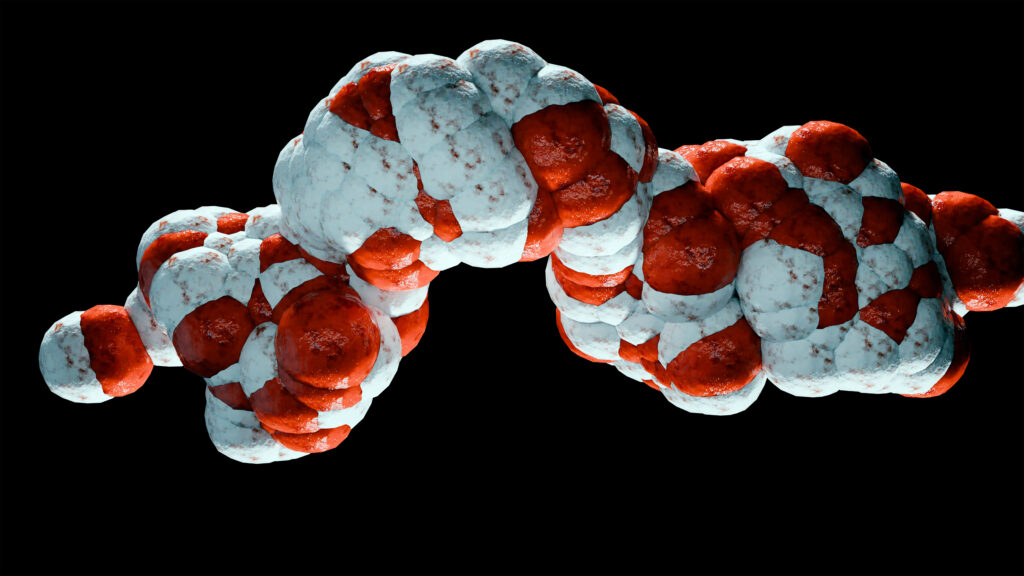

Sera Prognostics, based in Salt Lake City, Utah, specializes in women’s health diagnostics. The company develops and commercializes biomarker tests aimed at enhancing pregnancy outcomes in the United States. Notably, its flagship product, the PreTRM test, is designed to predict the risk of spontaneous preterm birth in singleton pregnancies. Founded in 2008, Sera Prognostics is also advancing a portfolio of tests targeting conditions such as preterm birth, preeclampsia, and gestational diabetes.

On the other hand, CarePayment Technologies, established in 1991 and located in Lake Oswego, Oregon, provides accounts receivable services tailored for healthcare providers. Operating under the CarePayment brand, the company focuses on managing financial transactions linked to healthcare services offered to patients.

As the healthcare sector continues to evolve, the contrasting financial profiles of CarePayment Technologies and Sera Prognostics present potential investors with critical considerations. The insights gained from this analysis may guide decisions about where to allocate resources in an increasingly competitive market.

In conclusion, while CarePayment Technologies demonstrates superior metrics across several financial aspects, Sera Prognostics remains a significant player in the women’s health diagnostics space. Investors should weigh these factors carefully when considering their next moves in the medical investment landscape.